Accounting for e-commerce and B2B SaaS in Estonia

Focus on your business. Let Enty take care of accounting

Accounting for e-commerce and B2B SaaS in Estonia

Focus on your business. Let Enty take care of accounting

Accounting for e-commerce and B2B SaaS in Estonia

Focus on your business. Let Enty take care of accounting

Running sales on e-commerce platforms? Get your accounting done with Enty

Running sales on e-commerce platforms? Get your accounting done with Enty

Running sales on e-commerce platforms? Get your accounting done with Enty

Transactions processed easily in one place

Connection with multiple bank accounts in different currencies

Compatible with sales reports from your platform

Built-in invoicing for your b2b sales

Transactions processed easily in one place

Connection with multiple bank accounts in different currencies

Compatible with sales reports from your platform

Built-in invoicing for your b2b sales

Transactions processed easily in one place

Connection with multiple bank accounts in different currencies

Compatible with sales reports from your platform

Built-in invoicing for your b2b sales

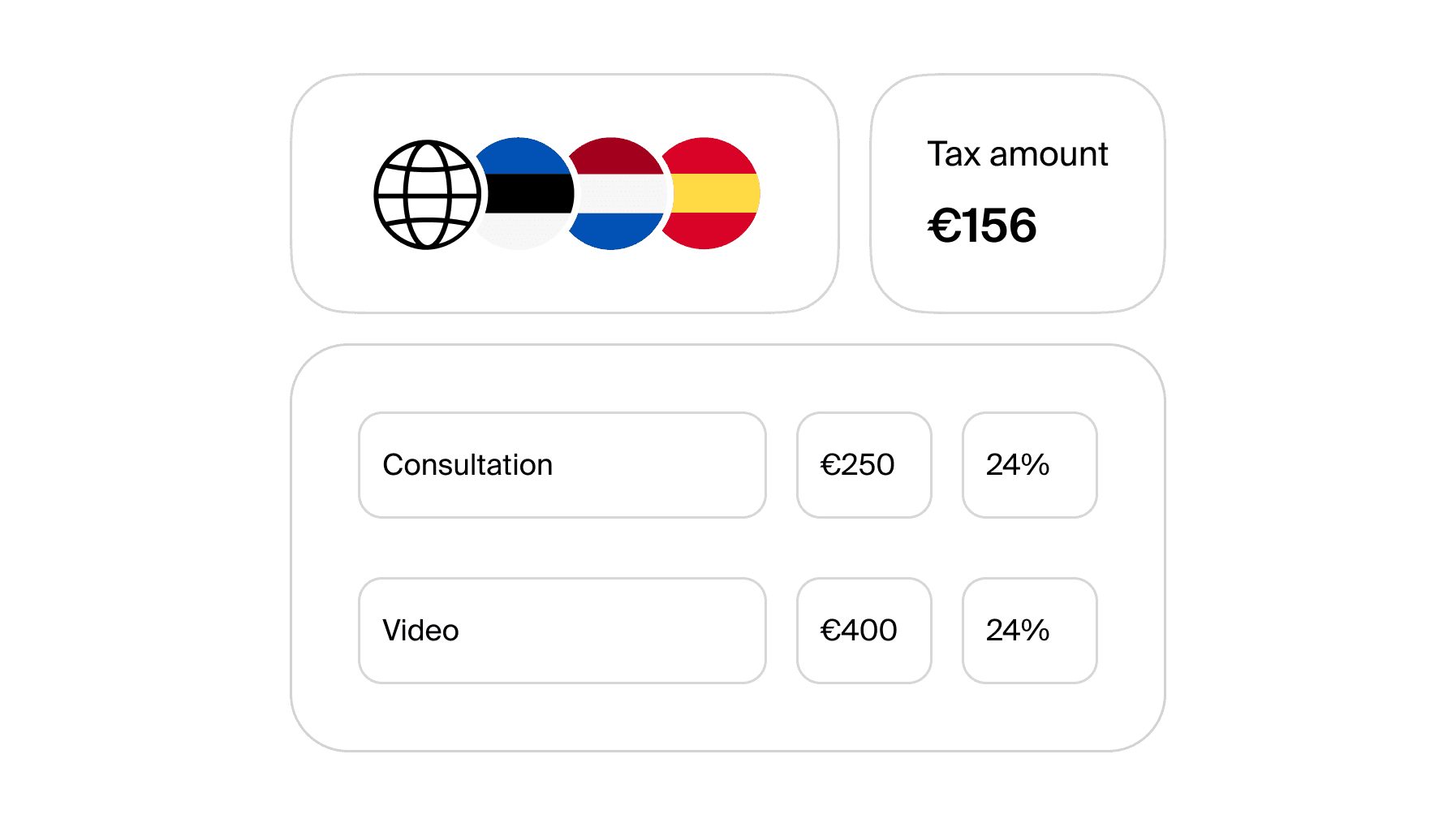

Declaring your VAT in Estonia for sales across Europe

Provide us with a breakdown of transactions by country, and we’ll handle the VAT declaration in Estonia on your behalf

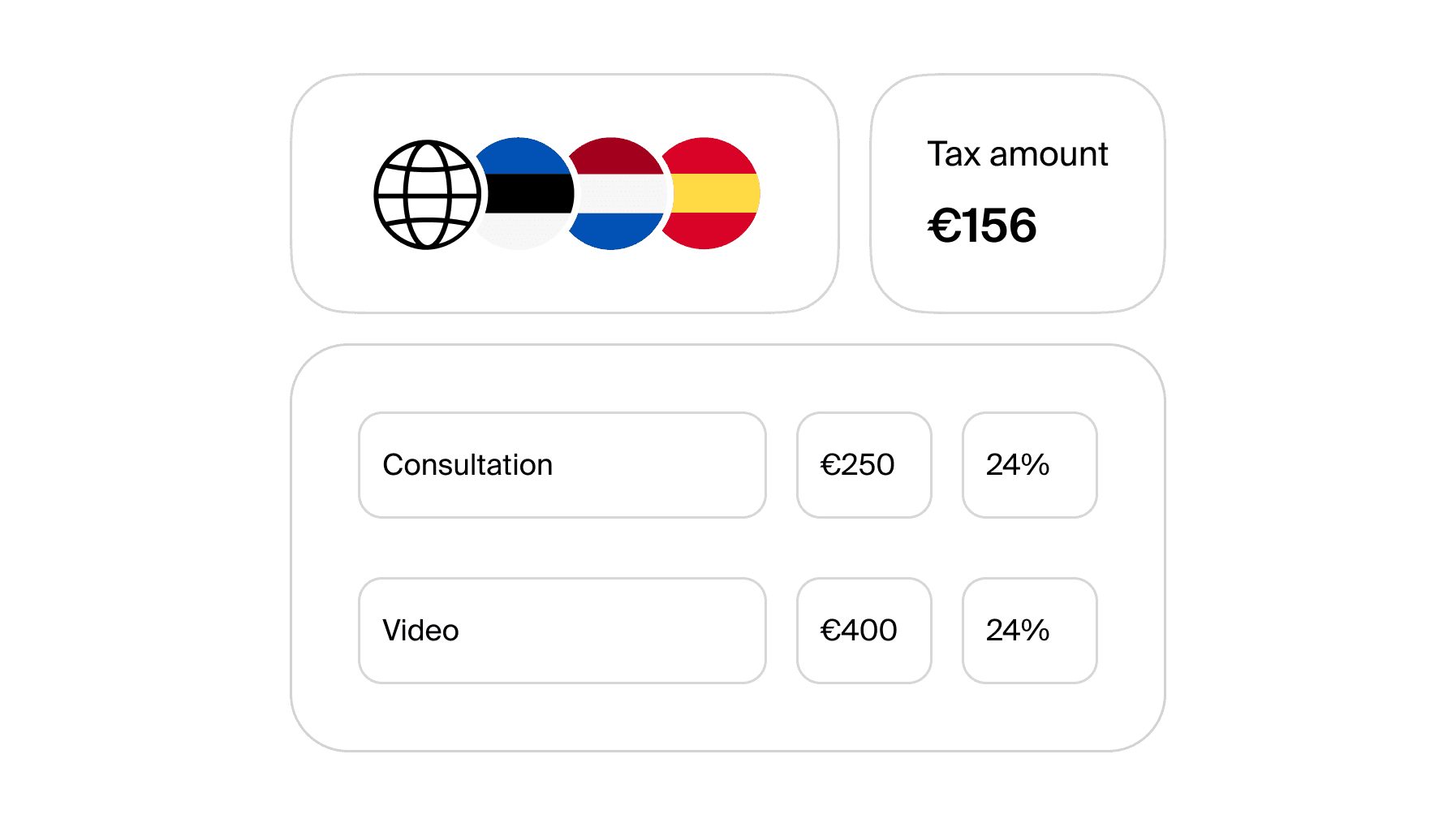

Declaring your VAT in Estonia for sales across Europe

Provide us with a breakdown of transactions by country, and we’ll handle the VAT declaration in Estonia on your behalf

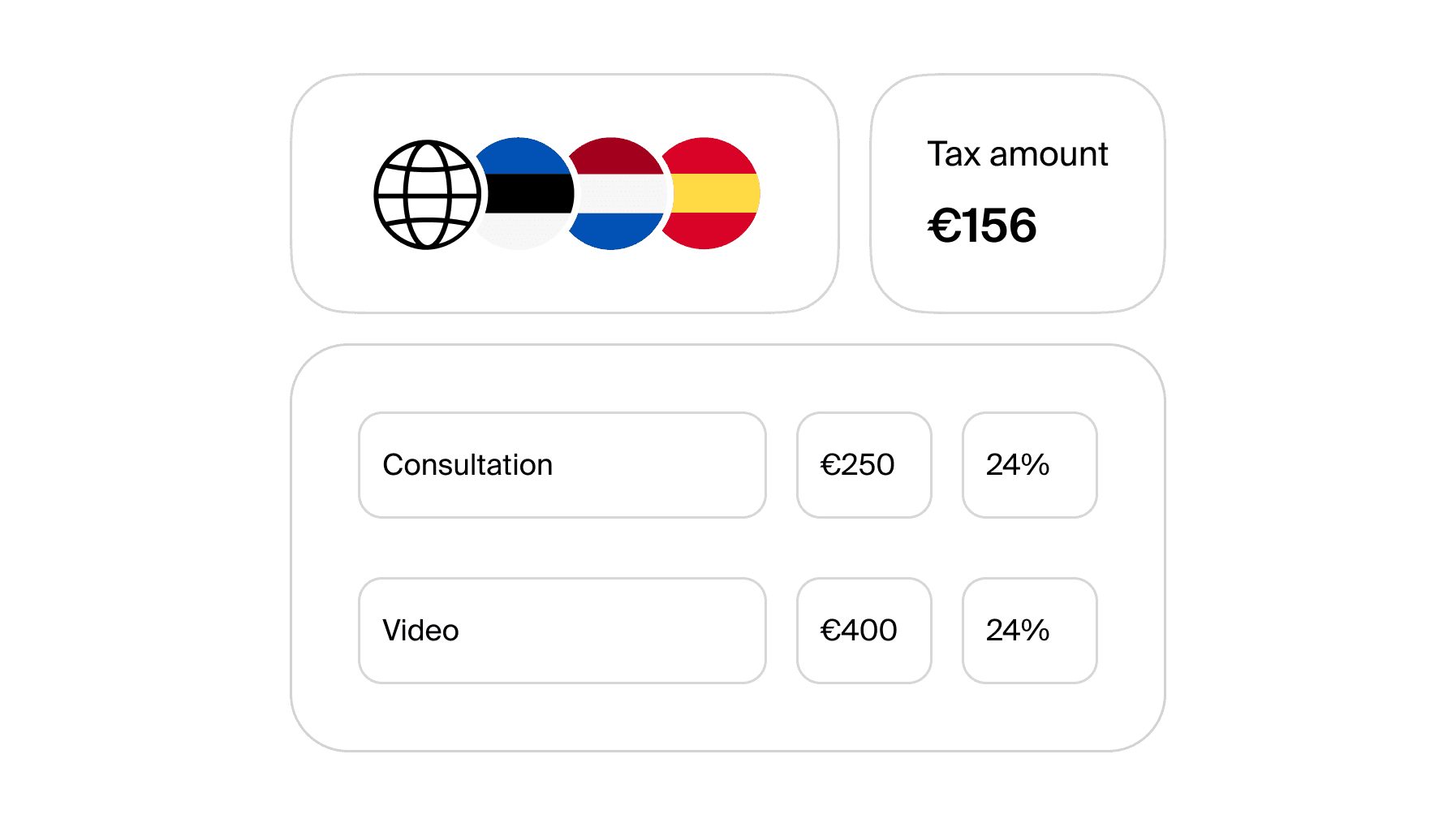

Declaring your VAT in Estonia for sales across Europe

Provide us with a breakdown of transactions by country, and we’ll handle the VAT declaration in Estonia on your behalf

E-commerce-savvy accountants at your service!

Platform fees, refunds, discounts and gift cards - we know how your business works

E-commerce-savvy accountants at your service!

Platform fees, refunds, discounts and gift cards - we know how your business works

E-commerce-savvy accountants at your service!

Platform fees, refunds, discounts and gift cards - we know how your business works

Defeating your accounting demons in 3 simple steps

Connect your company and bank account to Enty in a matter of minutes

Upload your sales reports and invoices. It’s easy and we’ll help if needed

Chill. Enty submits reports on your behalf

Defeating your accounting demons in 3 simple steps

Connect your company and bank account to Enty in a matter of minutes

Upload your sales reports and invoices. It’s easy and we’ll help if needed

Chill. Enty submits reports on your behalf

Defeating your accounting demons in 3 simple steps

Connect your company and bank account to Enty in a matter of minutes

Upload your sales reports and invoices. It’s easy and we’ll help if needed

Chill. Enty submits reports on your behalf

What about the price

What about the price

What about the price

Monthly

Yearly -15%

5 docs per month

+ Sales report from one e-com shop

€110

/ mo

€1320 / year

Included in all packages

VAT-return

Payroll submission

Annual report

Unlimited platforms

Accounting consultations

Multi-currency accounting

15 docs per month

+ Sales report from one e-com shop

€144

/ mo

€1728 / year

Included in all packages

VAT-return

Payroll submission

Annual report

Unlimited platforms

Accounting consultations

Multi-currency accounting

30 docs per month

+ Sales report from one e-com shop

€195

/ mo

€2340 / year

Included in all packages

VAT-return

Payroll submission

Annual report

Unlimited platforms

Accounting consultations

Multi-currency accounting

Monthly

Yearly -15%

5 docs per month

+ Sales report from one e-com shop

€110

/ mo

€1320 / year

Included in all packages

VAT-return

Payroll submission

Annual report

Unlimited platforms

Accounting consultations

Multi-currency accounting

15 docs per month

+ Sales report from one e-com shop

€144

/ mo

€1728 / year

Included in all packages

VAT-return

Payroll submission

Annual report

Unlimited platforms

Accounting consultations

Multi-currency accounting

30 docs per month

+ Sales report from one e-com shop

€195

/ mo

€2340 / year

Included in all packages

VAT-return

Payroll submission

Annual report

Unlimited platforms

Accounting consultations

Multi-currency accounting

Monthly

Yearly -15%

5 docs per month

+ Sales report from one e-com shop

€110

/ mo

€1320 / year

Included in all packages

VAT-return

Payroll submission

Annual report

Unlimited platforms

Accounting consultations

Multi-currency accounting

15 docs per month

+ Sales report from one e-com shop

€144

/ mo

€1728 / year

Included in all packages

VAT-return

Payroll submission

Annual report

Unlimited platforms

Accounting consultations

Multi-currency accounting

30 docs per month

+ Sales report from one e-com shop

€195

/ mo

€2340 / year

Included in all packages

VAT-return

Payroll submission

Annual report

Unlimited platforms

Accounting consultations

Multi-currency accounting

Note that the processing of each additional e-commerce shop report will cost €50

Note that the processing of each additional e-commerce shop report will cost €50

Note that the processing of each additional e-commerce shop report will cost €50

Why clients trust us

Why clients trust us

Why clients trust us

Enty is loved for cutting-edge products and exceptional support

2500+

clients worldwide

2 min

response time in chat

5 years

of flawless work

2500+

clients worldwide

2 min

response time in chat

5 years

of flawless work

2500+

clients worldwide

2 min

response time in chat

5 years

of flawless work

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Find more clients on Enty Hub

explore Enty Hub

Find more clients on Enty Hub

explore Enty Hub

Find more clients on Enty Hub

explore Enty Hub

Have a question?

Have a question?

Have a question?

Is Enty an accounting software or an accounting firm?

We are both. Enty will provide you with a simple and efficient accounting software to collect and forward all your documents to our accountant that will finally prepare and submit reports for you. You will be supported by your personal accounting manager along the way, and you will be able to get personal consultation with accountants via video call or in an email in case it is needed.

Is Enty an accounting software or an accounting firm?

We are both. Enty will provide you with a simple and efficient accounting software to collect and forward all your documents to our accountant that will finally prepare and submit reports for you. You will be supported by your personal accounting manager along the way, and you will be able to get personal consultation with accountants via video call or in an email in case it is needed.

Is Enty an accounting software or an accounting firm?

We are both. Enty will provide you with a simple and efficient accounting software to collect and forward all your documents to our accountant that will finally prepare and submit reports for you. You will be supported by your personal accounting manager along the way, and you will be able to get personal consultation with accountants via video call or in an email in case it is needed.

What accounting services do you provide?

We are accounting experts and provide you with any type of accounting reports and declarations. Annual reports, payrolls, VAT declarations, OSS/IOSS declarations and any other type of report you need. We can offer you one-time services (for example to submit reports for previous periods) and subscription-based services.

What accounting services do you provide?

We are accounting experts and provide you with any type of accounting reports and declarations. Annual reports, payrolls, VAT declarations, OSS/IOSS declarations and any other type of report you need. We can offer you one-time services (for example to submit reports for previous periods) and subscription-based services.

What accounting services do you provide?

We are accounting experts and provide you with any type of accounting reports and declarations. Annual reports, payrolls, VAT declarations, OSS/IOSS declarations and any other type of report you need. We can offer you one-time services (for example to submit reports for previous periods) and subscription-based services.

What accounting services are included in your subscription plans?

If you opt for the Ecom plan Enty will submit your monthly VAT declarations starting from the next month from the date you subscribed, as well as the annual report at the end of the year The annual report is included in the subscription price if Enty has received payment for at least 10 months of the year. So, if your payments cover less periods (basically, if you signed up after February and you opted to be charged on a monthly basis), you should pay extra - €59 per each missing month.

All the plans also include 1 payroll declaration per month.

What accounting services are included in your subscription plans?

If you opt for the Ecom plan Enty will submit your monthly VAT declarations starting from the next month from the date you subscribed, as well as the annual report at the end of the year The annual report is included in the subscription price if Enty has received payment for at least 10 months of the year. So, if your payments cover less periods (basically, if you signed up after February and you opted to be charged on a monthly basis), you should pay extra - €59 per each missing month.

All the plans also include 1 payroll declaration per month.

What accounting services are included in your subscription plans?

If you opt for the Ecom plan Enty will submit your monthly VAT declarations starting from the next month from the date you subscribed, as well as the annual report at the end of the year The annual report is included in the subscription price if Enty has received payment for at least 10 months of the year. So, if your payments cover less periods (basically, if you signed up after February and you opted to be charged on a monthly basis), you should pay extra - €59 per each missing month.

All the plans also include 1 payroll declaration per month.

How should I count transactions?

If you sell to consumers using e-commerce platforms - information about your sales and refunds is already well-organized. All you need to do is to export your monthly transactions categorized by countries in CSV format - we call it a sales report.

Each country in this report is a “transaction” from our pricing. So, if your buyers live in every EU country and in non-EU countries - your maximum number of transactions per month is 28.

Important notice: If you also conduct business-to-business (B2B) sales, each of these transactions is processed individually. Your sales report should include the VAT numbers of your B2B clients along with other relevant details. Also all transactions beyond sales reports (your company purchases) are counted separately.

How should I count transactions?

If you sell to consumers using e-commerce platforms - information about your sales and refunds is already well-organized. All you need to do is to export your monthly transactions categorized by countries in CSV format - we call it a sales report.

Each country in this report is a “transaction” from our pricing. So, if your buyers live in every EU country and in non-EU countries - your maximum number of transactions per month is 28.

Important notice: If you also conduct business-to-business (B2B) sales, each of these transactions is processed individually. Your sales report should include the VAT numbers of your B2B clients along with other relevant details. Also all transactions beyond sales reports (your company purchases) are counted separately.

How should I count transactions?

If you sell to consumers using e-commerce platforms - information about your sales and refunds is already well-organized. All you need to do is to export your monthly transactions categorized by countries in CSV format - we call it a sales report.

Each country in this report is a “transaction” from our pricing. So, if your buyers live in every EU country and in non-EU countries - your maximum number of transactions per month is 28.

Important notice: If you also conduct business-to-business (B2B) sales, each of these transactions is processed individually. Your sales report should include the VAT numbers of your B2B clients along with other relevant details. Also all transactions beyond sales reports (your company purchases) are counted separately.

What is a sales report?

A sales report is a document summarizing all sales transactions within a specific time frame. It usually includes details like the sale date, the product or service sold, the quantity or amount sold, the price per unit, and the total revenue generated. It's crucial to categorize clients by countries for accurate processing of the sales report.

What is a sales report?

A sales report is a document summarizing all sales transactions within a specific time frame. It usually includes details like the sale date, the product or service sold, the quantity or amount sold, the price per unit, and the total revenue generated. It's crucial to categorize clients by countries for accurate processing of the sales report.

What is a sales report?

A sales report is a document summarizing all sales transactions within a specific time frame. It usually includes details like the sale date, the product or service sold, the quantity or amount sold, the price per unit, and the total revenue generated. It's crucial to categorize clients by countries for accurate processing of the sales report.

I sell on several platforms, how does it affect the pricing?

If you are subscribed to our E-commerce plan, a Sales report from one e-com shop is included in the subscription. If you need to process additional reports, each extra e-com shop will cost €50.

Note that under an e-com platform (like Amazon or Shopify) you may have several separate e-com shops – each might require Sales report processing.

I sell on several platforms, how does it affect the pricing?

If you are subscribed to our E-commerce plan, a Sales report from one e-com shop is included in the subscription. If you need to process additional reports, each extra e-com shop will cost €50.

Note that under an e-com platform (like Amazon or Shopify) you may have several separate e-com shops – each might require Sales report processing.

I sell on several platforms, how does it affect the pricing?

If you are subscribed to our E-commerce plan, a Sales report from one e-com shop is included in the subscription. If you need to process additional reports, each extra e-com shop will cost €50.

Note that under an e-com platform (like Amazon or Shopify) you may have several separate e-com shops – each might require Sales report processing.

I am with another provider right now. How do I switch to Enty?

We will take care of your company's accounting right after you switch to us, starting at the beginning of the next month. If you need us to cover the previous month(s) – you should pay extra.

For a successful switch, you must provide us with 3 documents from your previous accounting provider:

Detailed balance for all accounts

General ledger for all accounts

Fixed assets and depreciation table, if applied

I am with another provider right now. How do I switch to Enty?

We will take care of your company's accounting right after you switch to us, starting at the beginning of the next month. If you need us to cover the previous month(s) – you should pay extra.

For a successful switch, you must provide us with 3 documents from your previous accounting provider:

Detailed balance for all accounts

General ledger for all accounts

Fixed assets and depreciation table, if applied

I am with another provider right now. How do I switch to Enty?

We will take care of your company's accounting right after you switch to us, starting at the beginning of the next month. If you need us to cover the previous month(s) – you should pay extra.

For a successful switch, you must provide us with 3 documents from your previous accounting provider:

Detailed balance for all accounts

General ledger for all accounts

Fixed assets and depreciation table, if applied

I have more questions about taxes and accounting

You can check our our Ultimate Guide to Accounting with Enty.

Or ask a question in the form below.

I have more questions about taxes and accounting

You can check our our Ultimate Guide to Accounting with Enty.

Or ask a question in the form below.

I have more questions about taxes and accounting

You can check our our Ultimate Guide to Accounting with Enty.

Or ask a question in the form below.

Didn’t find an answer? Ask us directly

Frequently Asked Questions (FAQ) are designed to provide quick answers to common inquiries about our services and features.

Didn’t find an answer? Ask us directly

Frequently Asked Questions (FAQ) are designed to provide quick answers to common inquiries about our services and features.

Didn’t find an answer? Ask us directly

Frequently Asked Questions (FAQ) are designed to provide quick answers to common inquiries about our services and features.

Read more about e-commerce businesses

Read more about e-commerce businesses

Read more about e-commerce businesses

Stay tuned as we release new features on a regular basis!

Stay tuned as we release new features on a regular basis!

Stay tuned as we release new features on a regular basis!

Take the stress out of admin and finance

No сredit card

Start in minutes

Boost processes instantly

Take the stress out of admin and finance

No сredit card

Start in minutes

Boost processes instantly

Take the stress out of admin and finance

No сredit card

Start in minutes

Boost processes instantly

No commitment, just clarity. Schedule your free call!