Accounting for Estonian Company

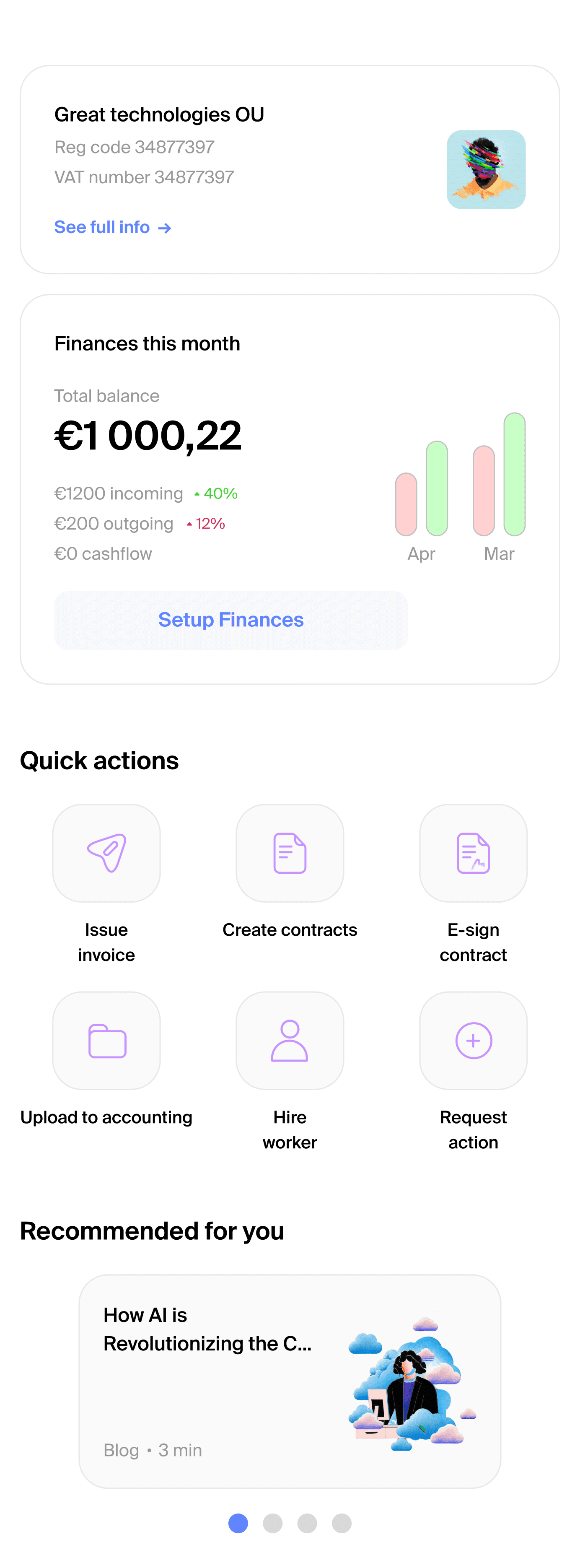

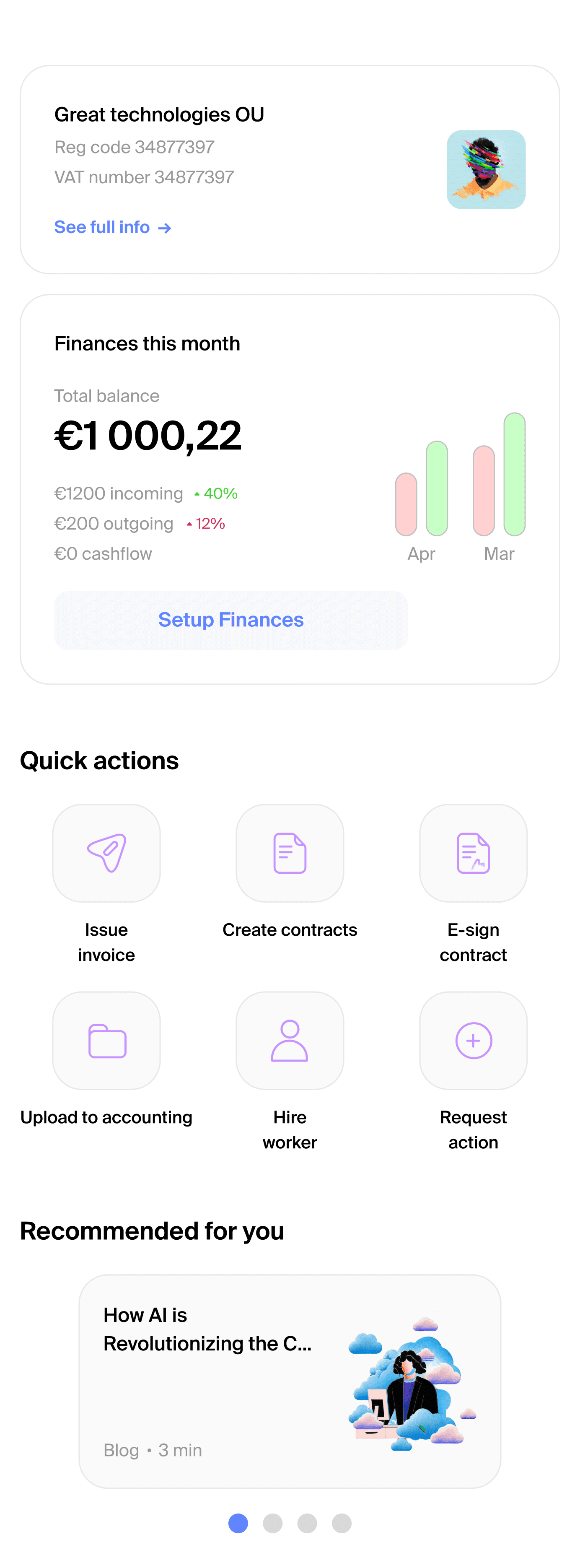

Don’t sweat yourself with Accounting! Save time and money with Enty

Accounting for Estonian Company

Don’t sweat yourself with Accounting! Save time and money with Enty

Accounting for Estonian Company

Don’t sweat yourself with Accounting! Save time and money with Enty

Enty Accounting is loved for its simplicity and personal touch

Enty Accounting is loved for its simplicity and personal touch

Enty Accounting is loved for its simplicity and personal touch

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

All that to serve one simple goal – get your reports submitted correctly and on time

All that to serve one simple goal – get your reports submitted correctly and on time

All that to serve one simple goal – get your reports submitted correctly and on time

We are here to help

New businesses

New to accounting in Estonia? Let us handle it from day one and set it up the best way

Established companies

We take accounting issues from your up-and-running business with a simple transfer process

Challenging cases

If you neglected accounting and things are a bit messy, we can put everything on the shelves

Enty covers any accounting issue you might face

There’s no stupid question about accounting

Let’s talk on a free call!

Annual report

VAT declaration

Employer declaration (TSD)

Employee registration

E-stat

Board member registration

Profit & Loss statement

Calculation of fixed and intangible assets

Consultation

Payroll

IOSS/OSS declaration

Zero declaration

Corrections to submitted declarations

Liquidation report

Foreign trade services

Incapacity certificate

Late declaration

We are here to help

New businesses

New to accounting in Estonia? Let us handle it from day one and set it up the best way

Established companies

We take accounting issues from your up-and-running business with a simple transfer process

Challenging cases

If you neglected accounting and things are a bit messy, we can put everything on the shelves

There’s no stupid question about accounting

Let’s talk on a free call!

Annual report

VAT declaration

Employer declaration (TSD)

Employee registration

E-stat

Board member registration

Profit & Loss statement

Calculation of fixed and intangible assets

Consultation

Payroll

IOSS/OSS declaration

Zero declaration

Corrections to submitted declarations

Liquidation report

Foreign trade services

Incapacity certificate

Late declaration

Enty covers any accounting issue you might face

We are here to help

New businesses

New to accounting in Estonia? Let us handle it from day one and set it up the best way

Established companies

We take accounting issues from your up-and-running business with a simple transfer process

Challenging cases

If you neglected accounting and things are a bit messy, we can put everything on the shelves

Enty covers any accounting issue you might face

There’s no stupid question about accounting

Let’s talk on a free call!

Annual report

VAT declaration

Employer declaration (TSD)

Employee registration

E-stat

Board member registration

Profit & Loss statement

Calculation of fixed and intangible assets

Consultation

Payroll

IOSS/OSS declaration

Zero declaration

Corrections to submitted declarations

Liquidation report

Foreign trade services

Incapacity certificate

Late declaration

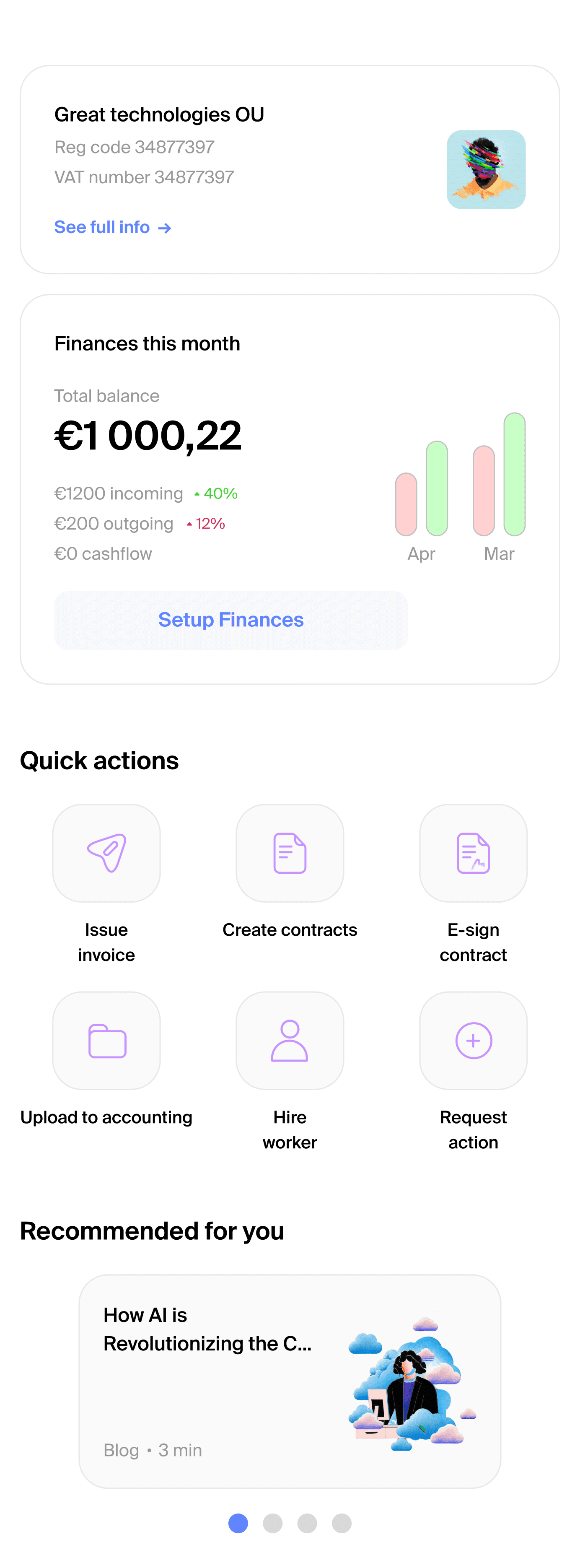

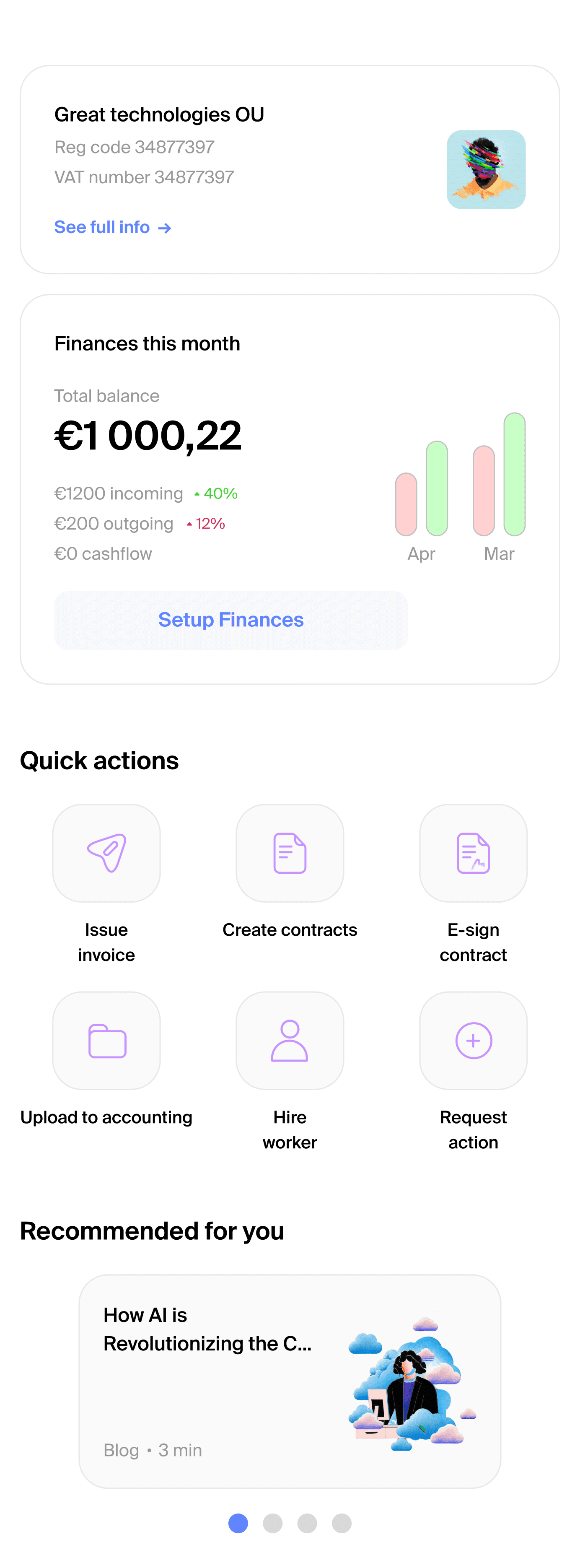

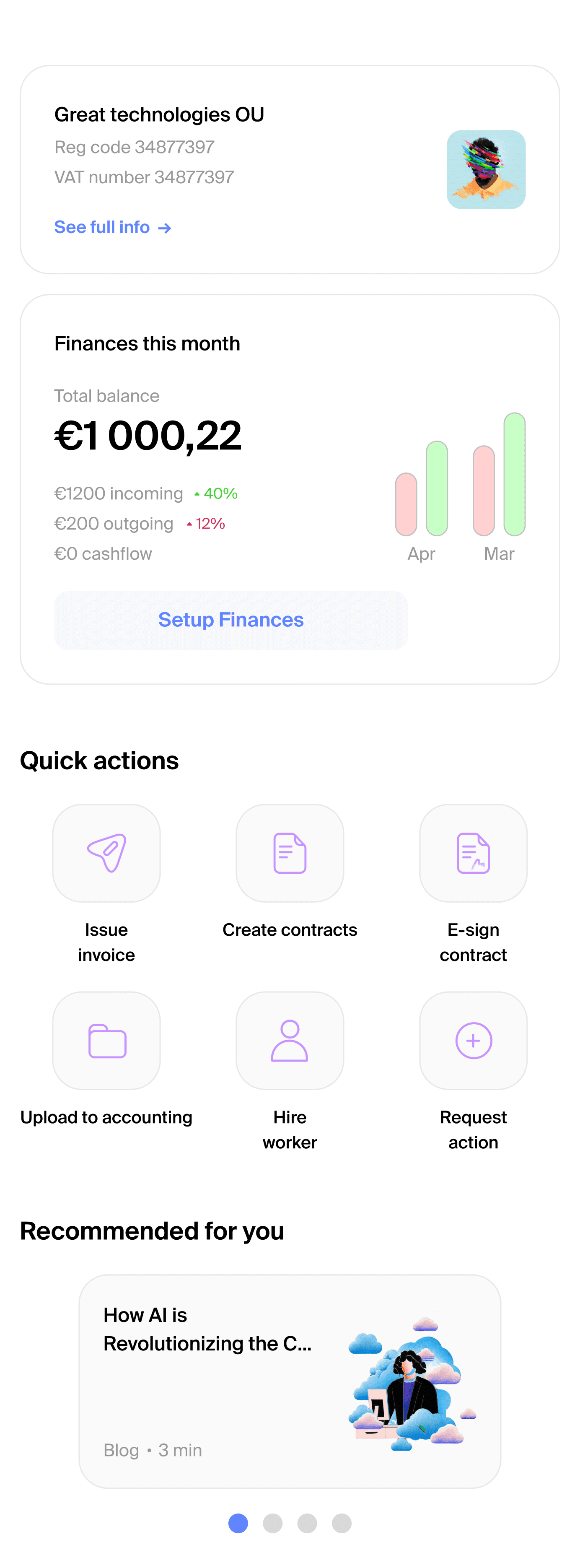

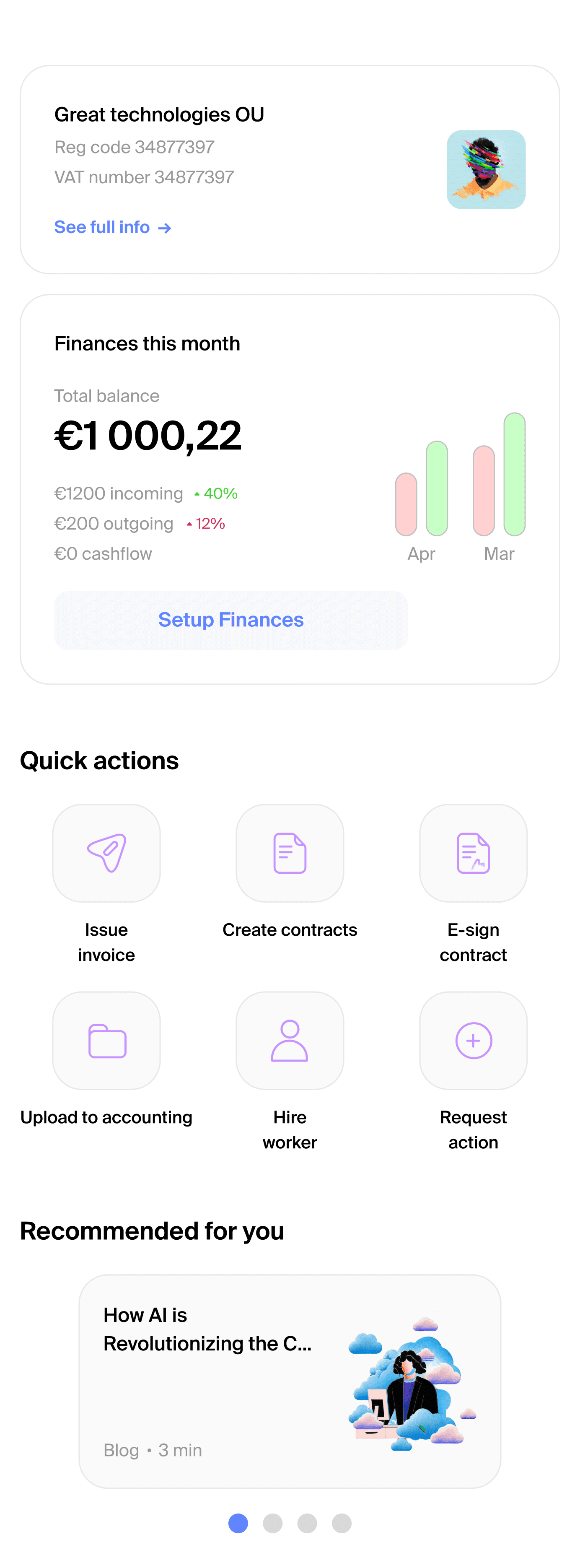

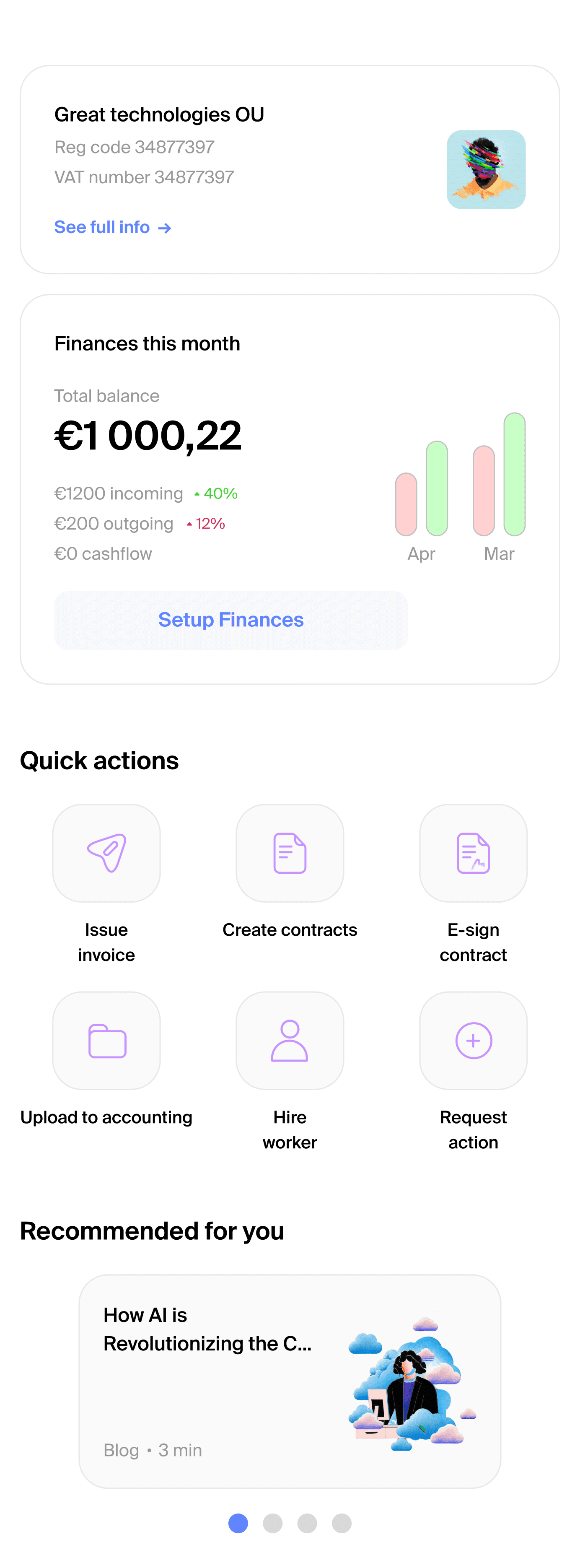

We take care of papers while you mind your business

We take care of papers while you mind your business

We take care of papers while you mind your business

Invoice like a pro

Create invoices or upload supplier invoices in many ways

Invoice like a pro

Create invoices or upload supplier invoices in many ways

Create invoices or upload supplier invoices in many ways

Invoice like a pro

Create invoices or upload supplier invoices in many ways

Create invoices or upload supplier invoices in many ways

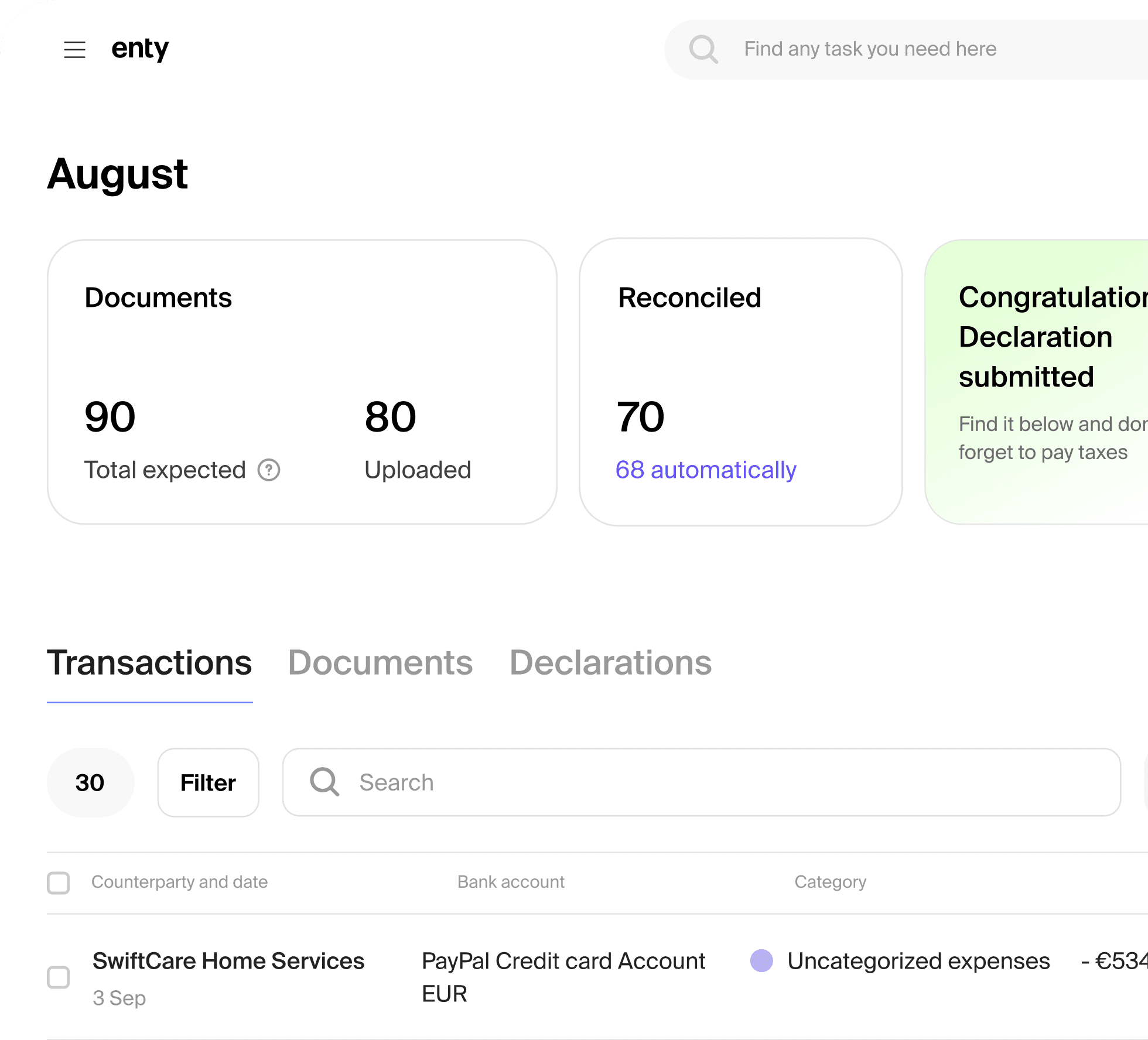

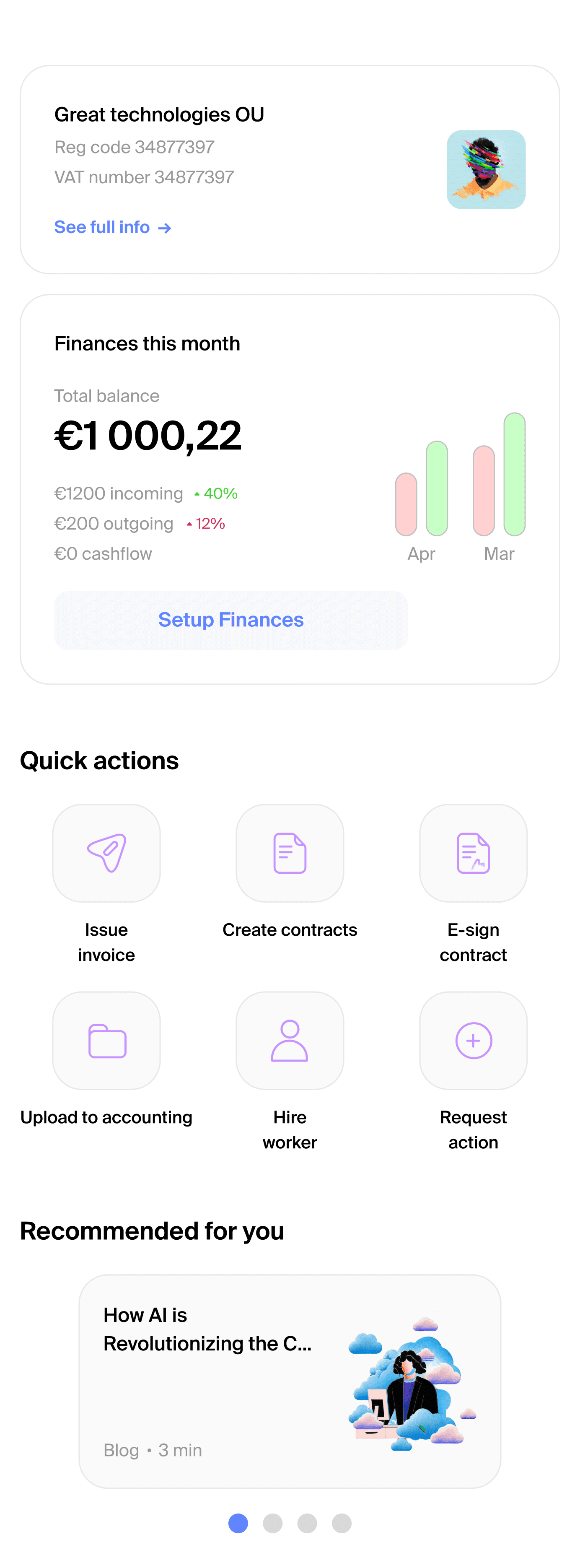

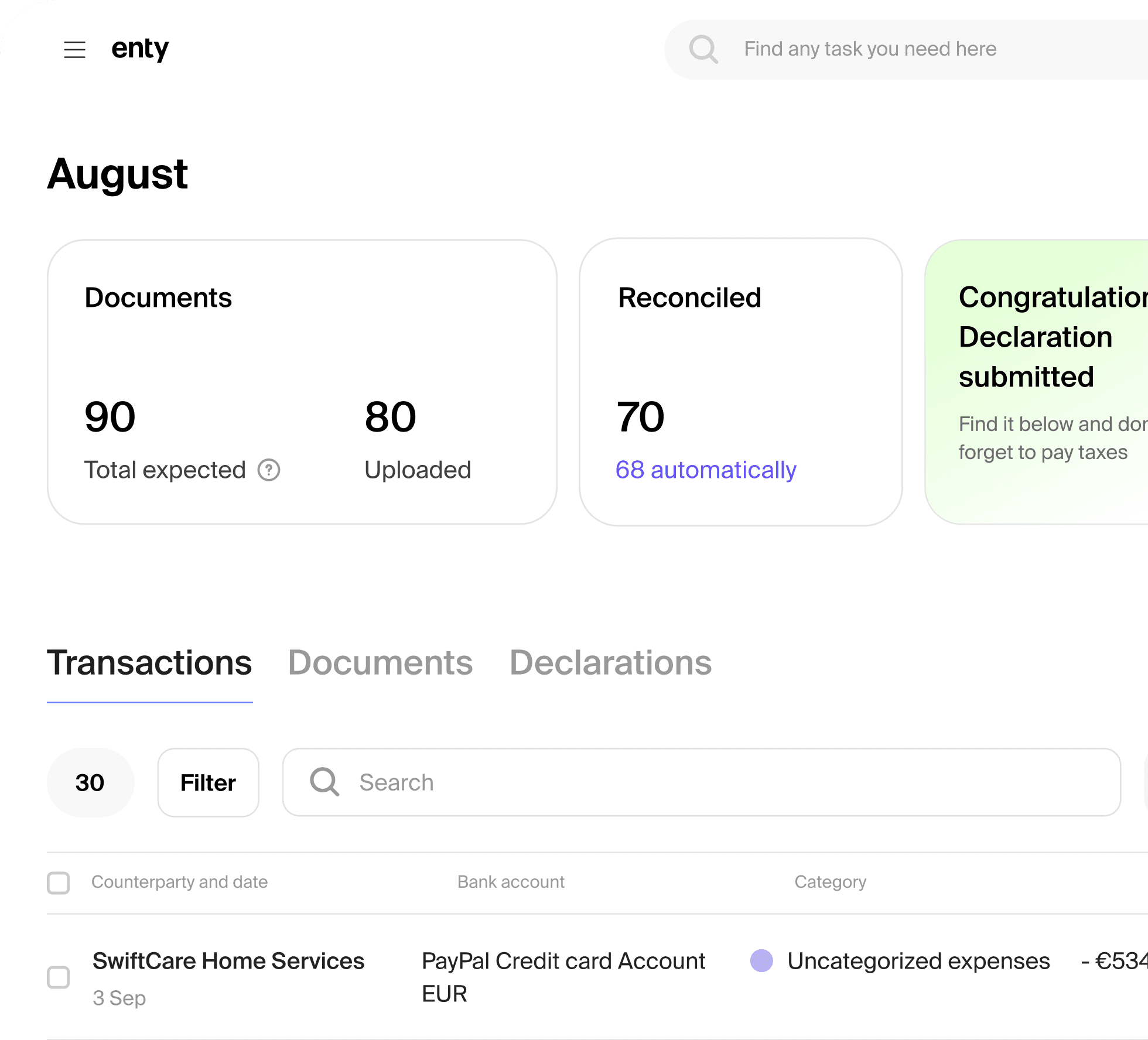

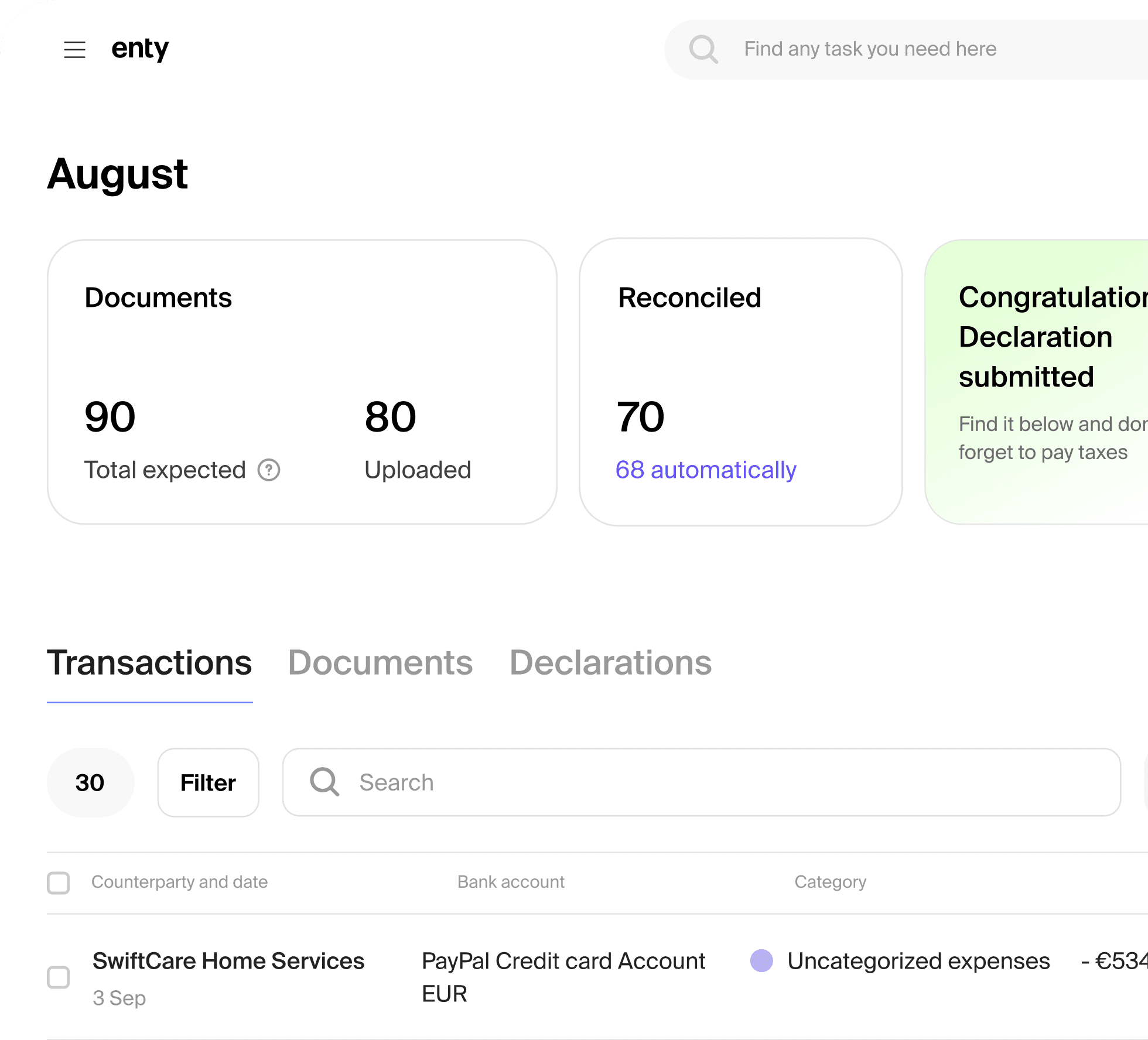

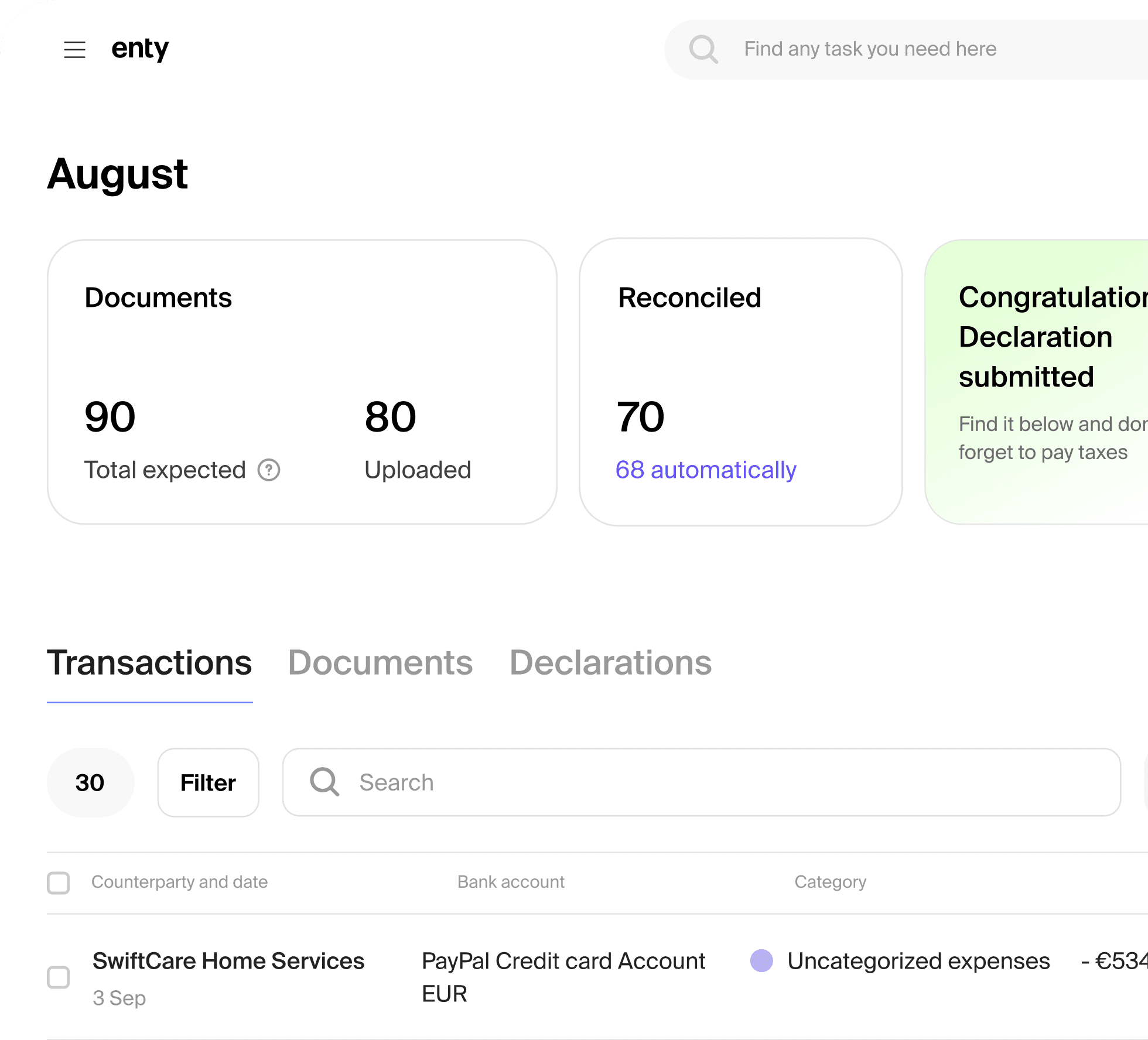

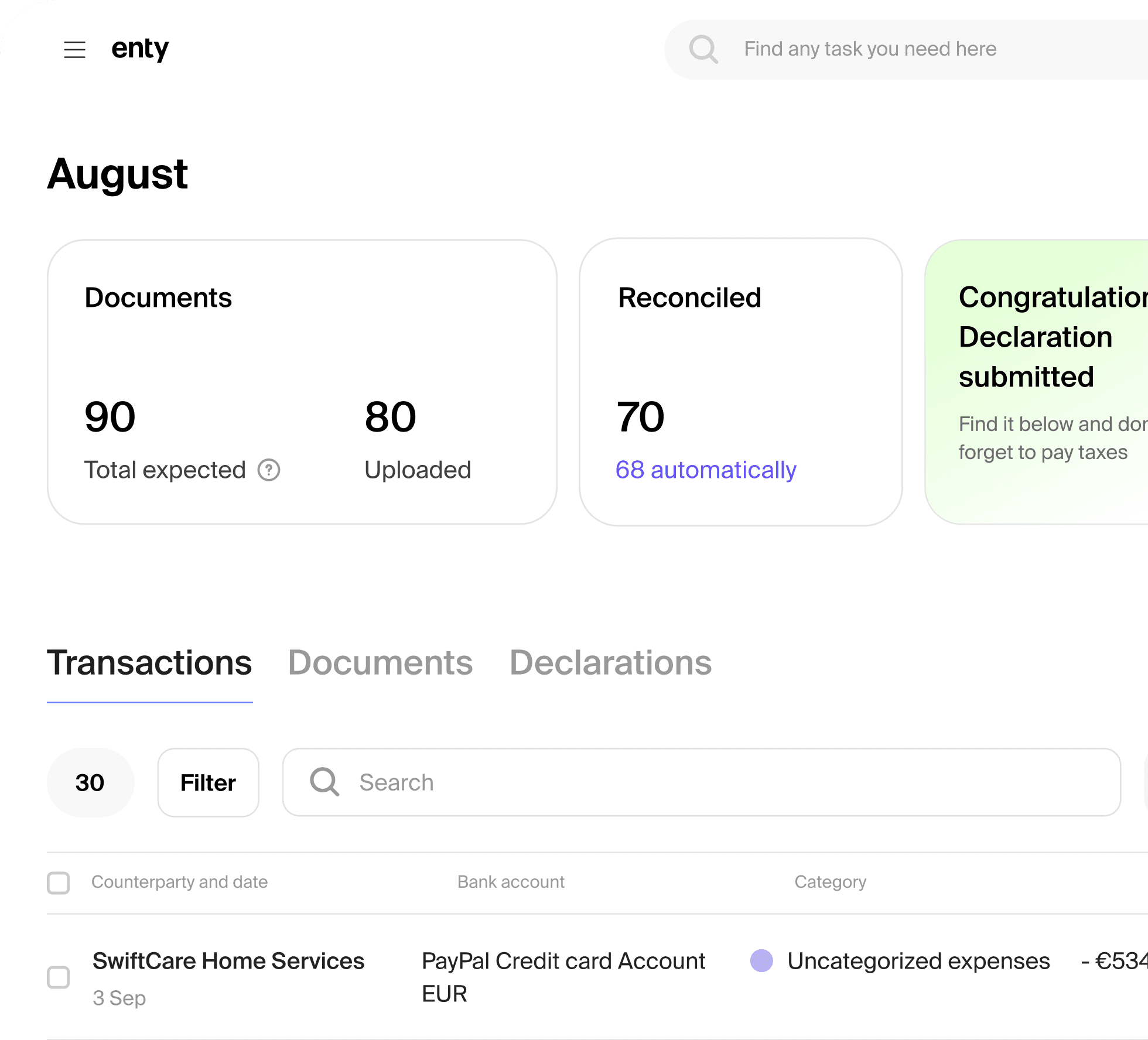

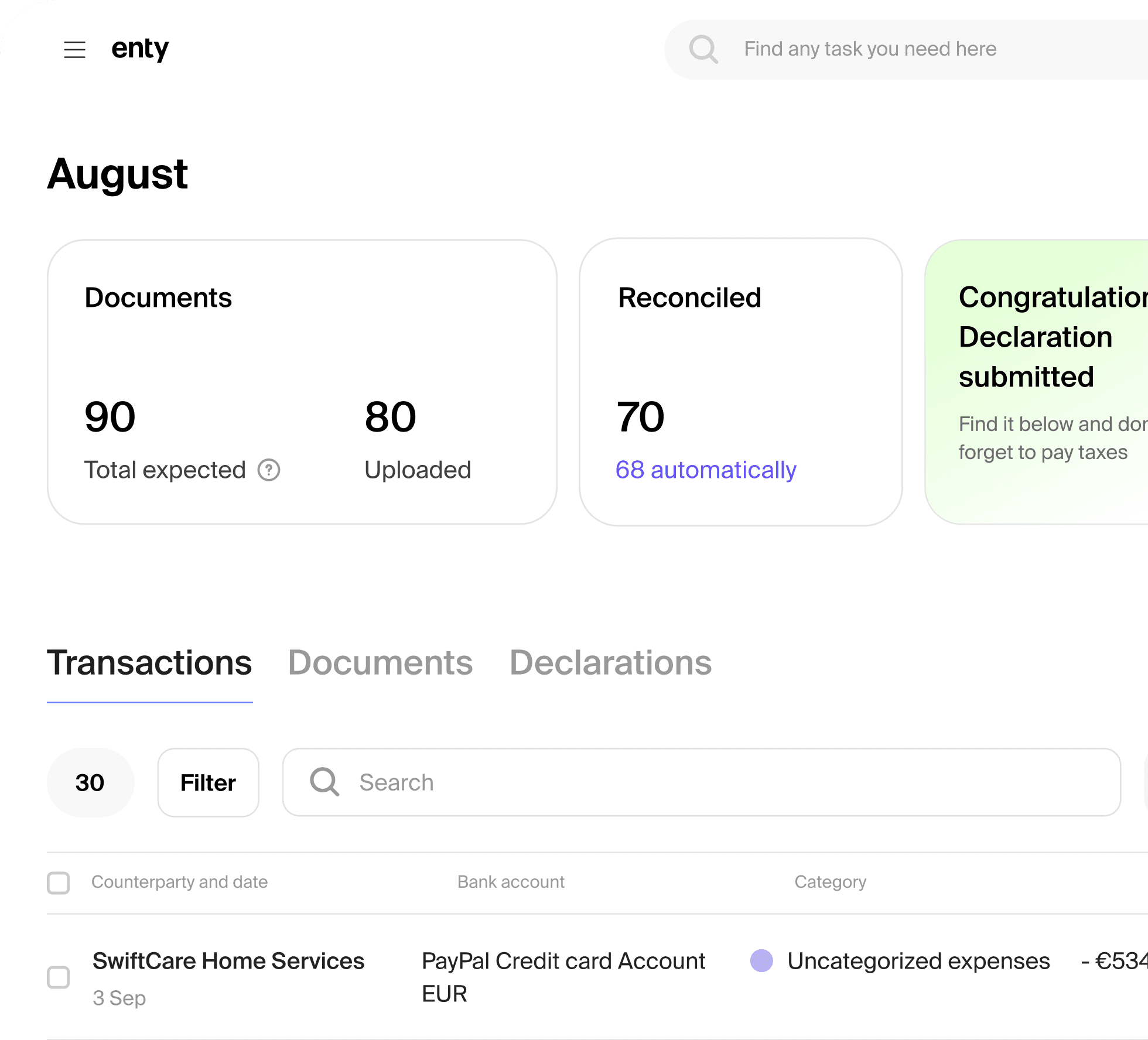

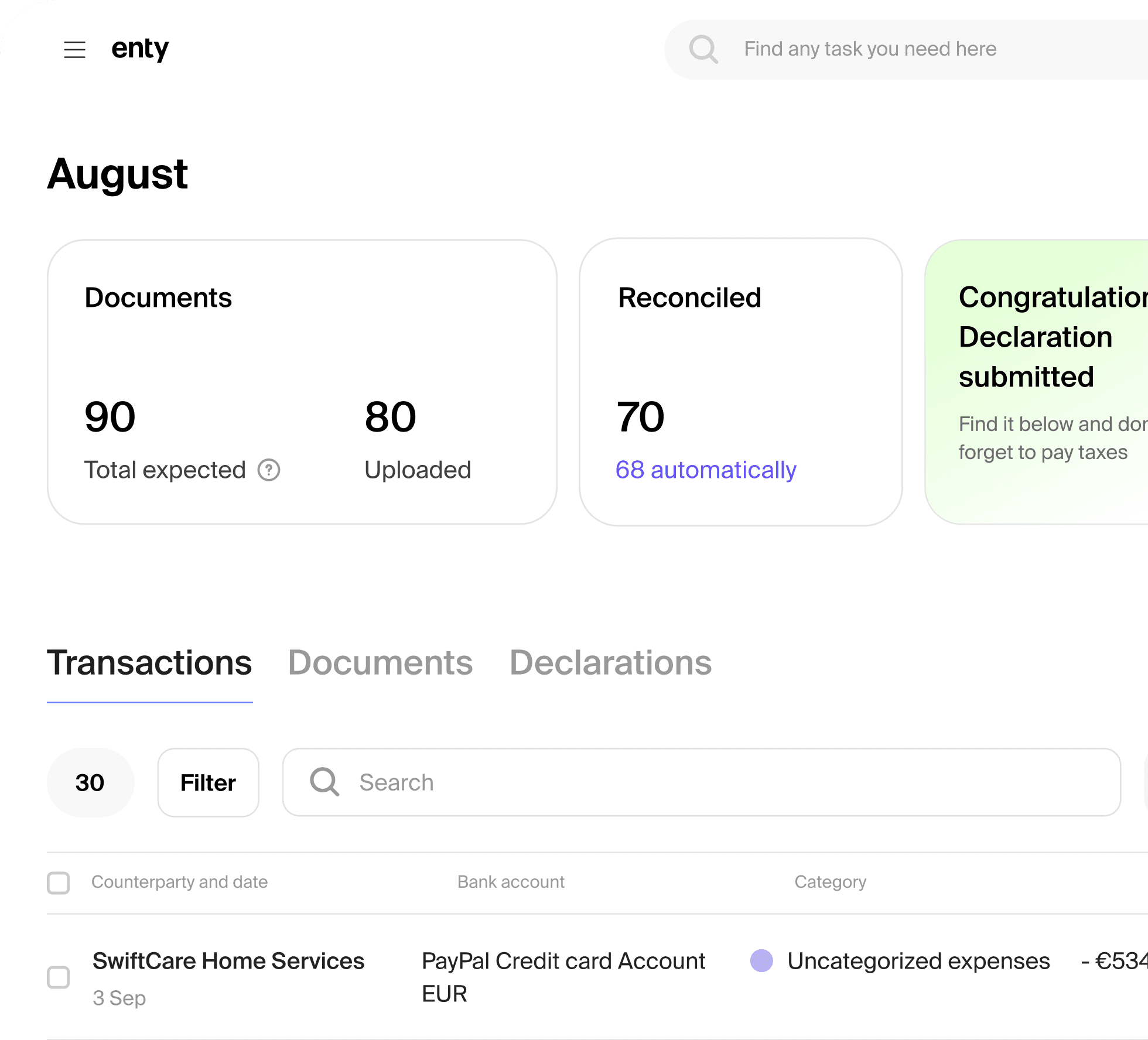

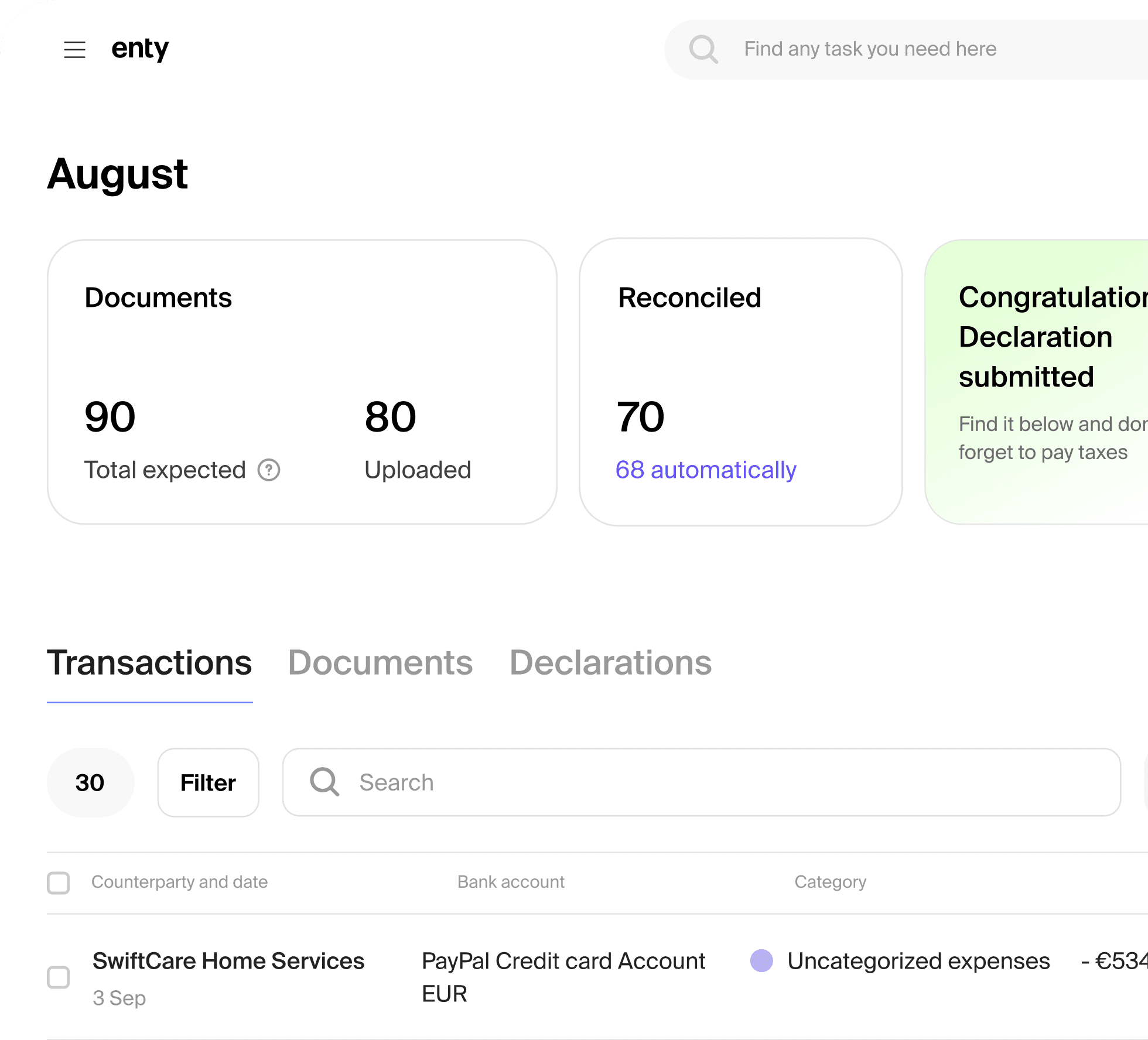

Auto-match your docs

Reconcile documents with your transactions automatically or manually

Auto-match your docs

Reconcile documents with your transactions automatically or manually

Reconcile documents with your transactions automatically or manually

Auto-match your docs

Reconcile documents with your transactions automatically or manually

Reconcile documents with your transactions automatically or manually

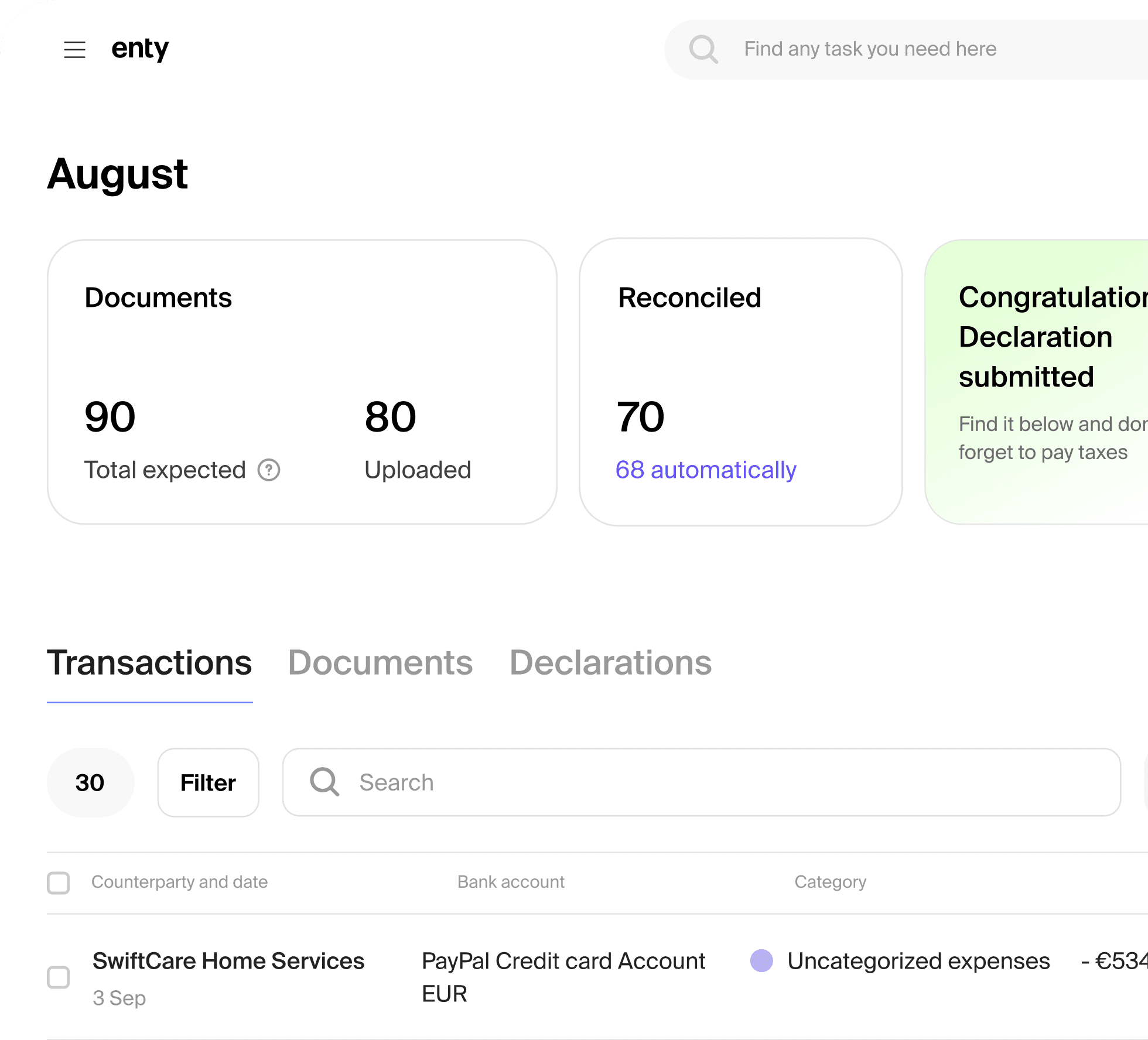

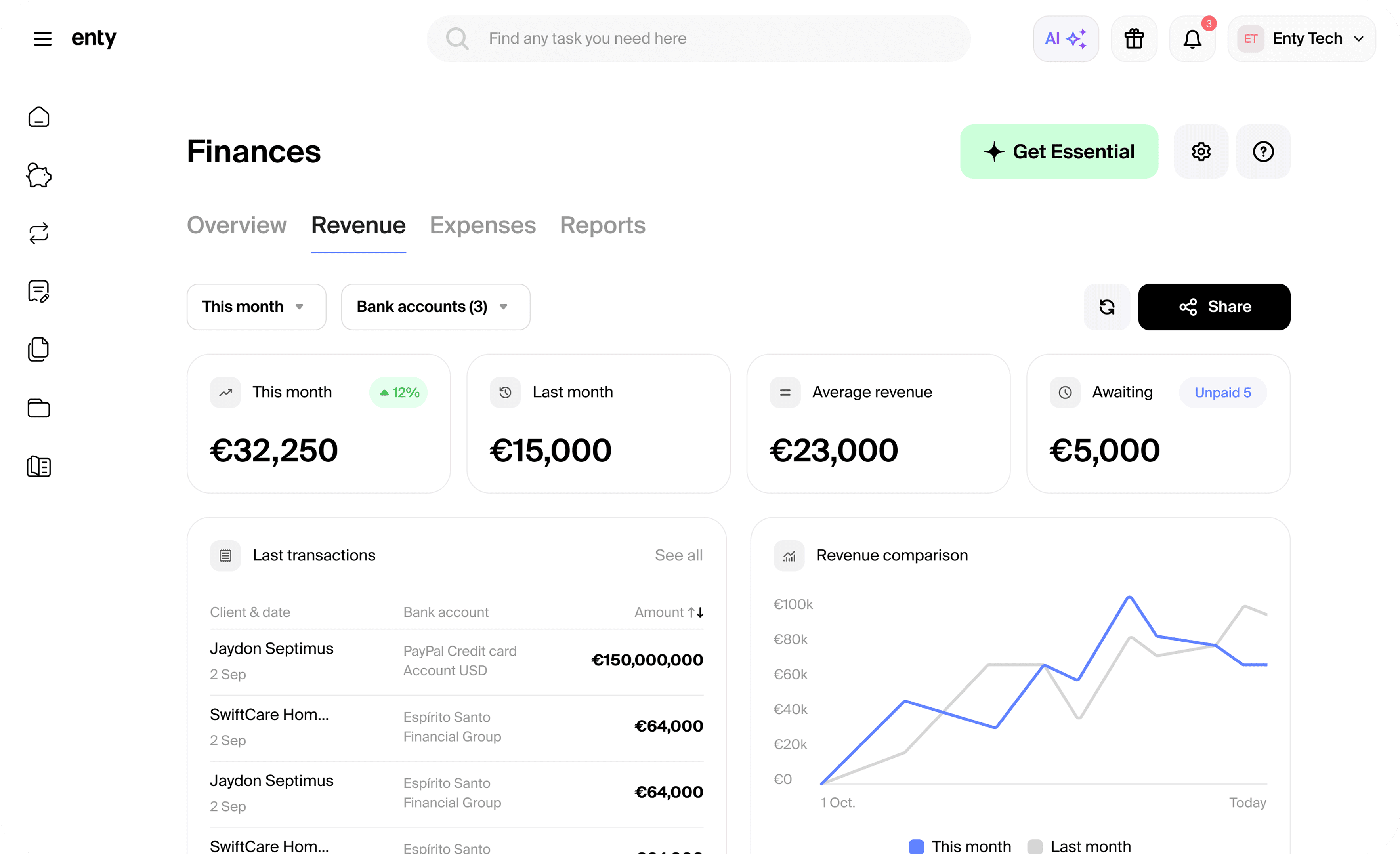

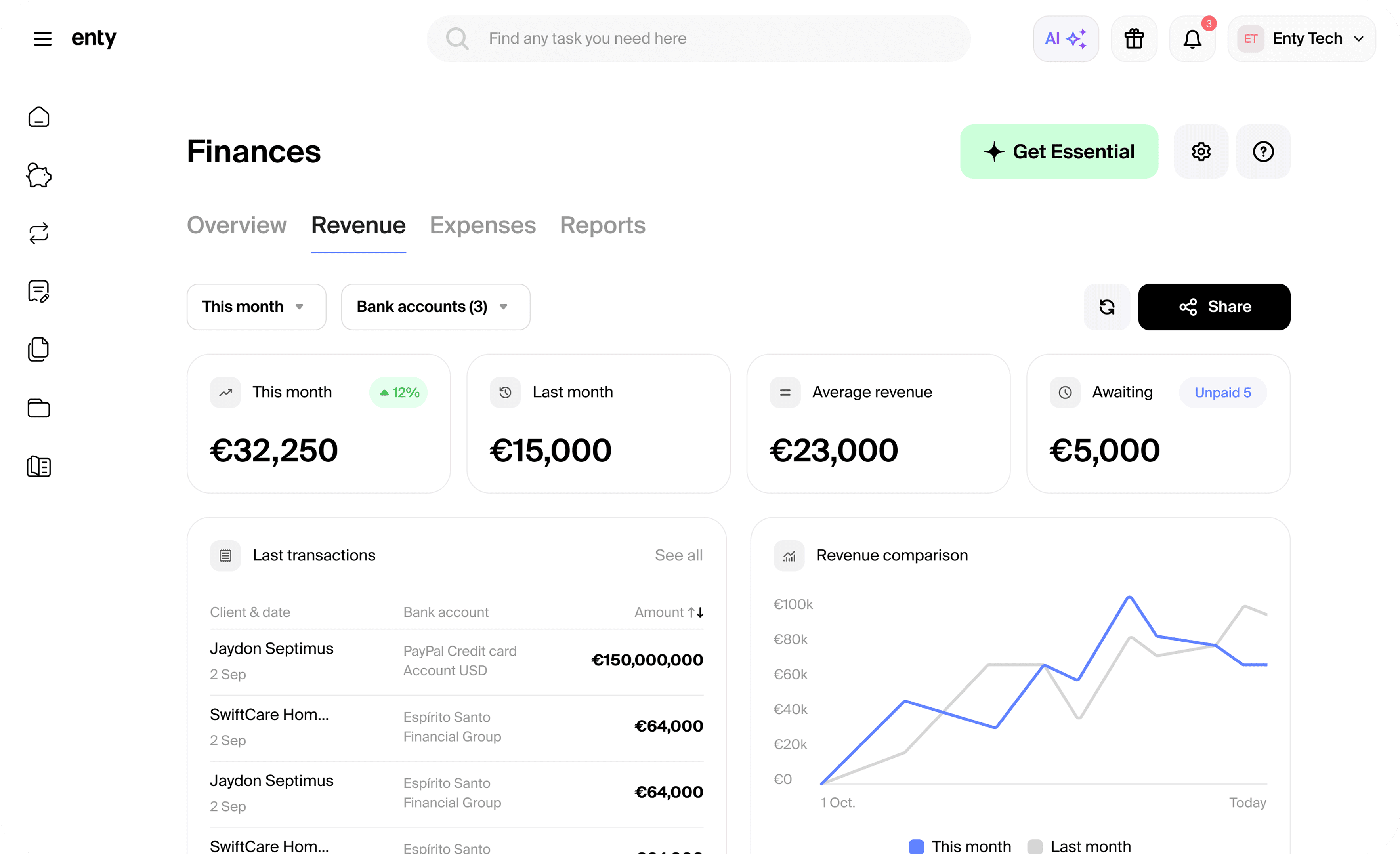

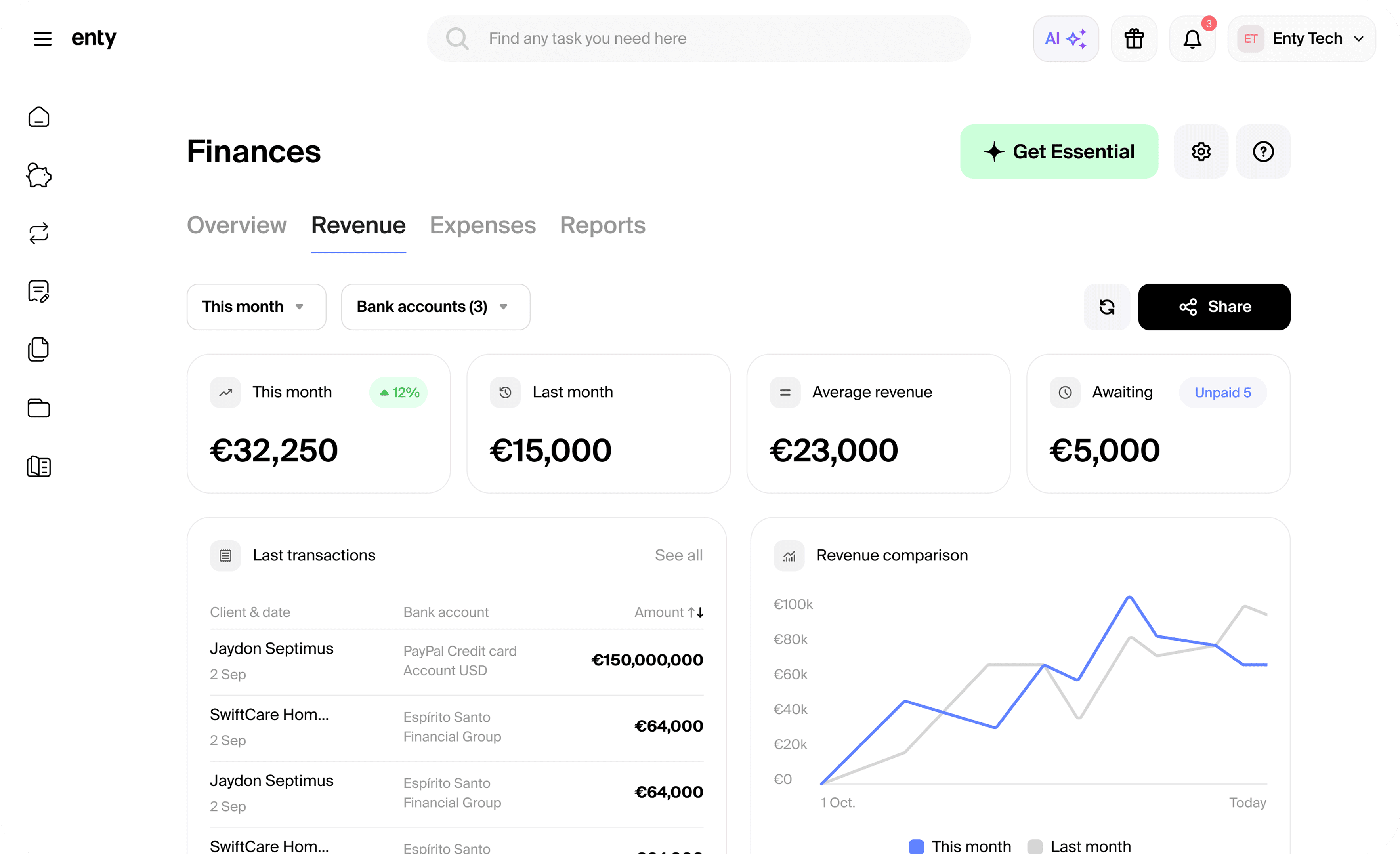

Control finances

Connect 1500+ banks, track cash flow, and generate financial reports

Control finances

Connect 1500+ banks, track cash flow, and generate financial reports

Control finances

Connect 1500+ banks, track cash flow, and generate financial reports

Control finances

Connect 1500+ banks, track cash flow, and generate financial reports

Control finances

Connect 1500+ banks, track cash flow, and generate financial reports

Pay and get paid

Payroll, salaries, dividends, reimbursements, you name them

Pay and get paid

Payroll, salaries, dividends, reimbursements, you name them

Pay and get paid

Payroll, salaries, dividends, reimbursements, you name them

Pay and get paid

Payroll, salaries, dividends, reimbursements, you name them

Pay and get paid

Payroll, salaries, dividends, reimbursements, you name them

Taxes are covered too

Auto-calculate the taxes and get just one link to pay them all

Taxes are covered too

Auto-calculate the taxes and get just one link to pay them all

Taxes are covered too

Auto-calculate the taxes and get just one link to pay them all

Taxes are covered too

Auto-calculate the taxes and get just one link to pay them all

Taxes are covered too

Auto-calculate the taxes and get just one link to pay them all

Never miss a deadline

Receive timely reminders to upload your documents

Never miss a deadline

Receive timely reminders to upload your documents

Never miss a deadline

Receive timely reminders to upload your documents

Never miss a deadline

Receive timely reminders to upload your documents

Never miss a deadline

Receive timely reminders to upload your documents

Choose the package that suits you best

Choose the package that suits you best

Choose the package that suits you best

Plans for every business, with optional add-ons when needed

Plans for every business, with optional add-ons when needed

Monthly

Yearly -15%

Annual reporting

For companies without VAT

€51

/ mo

€612 / year

transactions / year

30

60

What’s included

Personal manager

Annual report filing

Payroll report for 1 employee

1 hour video-call consultation per year

Monthly reporting

For businesses with a VAT number

€93

/ mo

€1116 / year

transactions / month

15

30

50

What’s included

Personal manager

Annual report filing

Monthly VAT filing

Payroll reporting for 1 employee

1 hour video-call consultation per month

E-com & B2B SaaS

Suits companies that sell products on e-commerce platform or B2B SaaS

€110

/ mo

€1320 / year

transactions / month

5

15

30

What’s included

Personal manager

Annual report filing

Monthly VAT filing

Processing of a sales report from one e-com shop

Payroll reporting for 1 employee

1 hour video-call consultation per month

Monthly

Yearly -15%

Annual reporting

For companies without VAT

€51

/ mo

€612 / year

30

60

transactions / year

What’s included

Personal manager

Annual report filing

Payroll report for 1 employee

1 hour video-call consultation per year

Monthly reporting

For businesses with a VAT number

€93

/ mo

€1116 / year

15

30

50

transactions / month

What’s included

Personal manager

Annual report filing

Monthly VAT filing

Payroll reporting for 1 employee

1 hour video-call consultation per month

E-com & B2B SaaS

Suits companies that sell products on e-commerce platform or B2B SaaS

€110

/ mo

€1320 / year

5

15

30

transactions / month

What’s included

Personal manager

Annual report filing

Monthly VAT filing

Processing of a sales report from one e-com shop

Payroll reporting for 1 employee

1 hour video-call consultation per month

Monthly

Yearly -15%

Annual reporting

For companies without VAT

€51

/ mo

€612 / year

30

60

transactions / year

What’s included

Personal manager

Annual report filing

Payroll report for 1 employee

1 hour video-call consultation per year

Monthly reporting

For businesses with a VAT number

€93

/ mo

€1116 / year

15

30

50

transactions / month

What’s included

Personal manager

Annual report filing

Monthly VAT filing

Payroll reporting for 1 employee

1 hour video-call consultation per month

E-com & B2B SaaS

Suits companies that sell products on e-commerce platform or B2B SaaS

€110

/ mo

€1320 / year

5

15

30

transactions / month

What’s included

Personal manager

Annual report filing

Monthly VAT filing

Processing of a sales report from one e-com shop

Payroll reporting for 1 employee

1 hour video-call consultation per month

Accounting over the plan limits

Each transaction over limit

€5

Extra payroll

€30

Extra consultations

€90 / hour

Extra e-com shop

€50

OSS reporting

€50 / quarter

IOSS reporting

€40 / month

Reports for previous period (annual, VAT)

from €119

Processing of investment report

€120

Delayed Accounting

We strive for timely report submission. To do so, we request accounting papers from clients by the 5th of the next month. If a client fails to do that, we may charge extra because our team will have to work overtime

Late documents fee

up to €50 / mo

Possible gov fines

from €100

Accounting over the plan limits

Each transaction over limit

€5

Extra payroll

€30

Extra consultations

€90 / hour

Extra e-com shop

€50

OSS reporting

€50 / quarter

IOSS reporting

€40 / month

Reports for previous period (annual, VAT)

from €119

Processing of investment report

€120

Delayed Accounting

We strive for timely report submission. To do so, we request accounting papers from clients by the 5th of the next month. If a client fails to do that, we may charge extra because our team will have to work overtime

Late documents fee

up to €50 / mo

Possible gov fines

from €100

Accounting over the plan limits

Each transaction over limit

€5

Extra payroll

€30

Extra consultations

€90 / hour

Extra e-com shop

€50

OSS reporting

€50 / quarter

IOSS reporting

€40 / month

Reports for previous period (annual, VAT)

from €119

Processing of investment report

€120

Delayed Accounting

We strive for timely report submission. To do so, we request accounting papers from clients by the 5th of the next month. If a client fails to do that, we may charge extra because our team will have to work overtime

Late documents fee

up to €50 / mo

Possible gov fines

from €100

Great accounting is hard to leave.

97% of new clients stay with Enty

Great accounting is hard to leave.

97% of new clients stay with Enty

Great accounting is hard to leave.

97% of new clients stay with Enty

2500+

clients worldwide

7051

declarations submitted last year

5 years

of flawless work

2500+

clients worldwide

7051

declarations submitted last year

5 years

of flawless work

2500+

clients worldwide

7051

declarations submitted last year

5 years

of flawless work

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Find more clients on Enty Hub

explore Enty Hub

Find more clients on Enty Hub

explore Enty Hub

Find more clients on Enty Hub

explore Enty Hub

Have a question on accounting?

Have a question on accounting?

Have a question on accounting?

What are the accounting requirements for Estonian companies?

All companies registered in Estonia — even those that don’t have activity— must meet specific accounting obligations. To stay compliant, you need to:

Submit an annual report to the Estonian Business Register every year

Preserve accounting documents for at least 7 years — this includes bank statements, invoices, contracts, receipts, and any other supporting documents

File monthly VAT returns (if your company is VAT-registered)

These requirements apply regardless of whether your company has active income or not.

Enty helps you stay compliant automatically by generating reports, syncing transactions, and handling VAT declarations — so you don’t have to worry about missing a deadline.

What are the accounting requirements for Estonian companies?

All companies registered in Estonia — even those that don’t have activity— must meet specific accounting obligations. To stay compliant, you need to:

Submit an annual report to the Estonian Business Register every year

Preserve accounting documents for at least 7 years — this includes bank statements, invoices, contracts, receipts, and any other supporting documents

File monthly VAT returns (if your company is VAT-registered)

These requirements apply regardless of whether your company has active income or not.

Enty helps you stay compliant automatically by generating reports, syncing transactions, and handling VAT declarations — so you don’t have to worry about missing a deadline.

What are the accounting requirements for Estonian companies?

All companies registered in Estonia — even those that don’t have activity— must meet specific accounting obligations. To stay compliant, you need to:

Submit an annual report to the Estonian Business Register every year

Preserve accounting documents for at least 7 years — this includes bank statements, invoices, contracts, receipts, and any other supporting documents

File monthly VAT returns (if your company is VAT-registered)

These requirements apply regardless of whether your company has active income or not.

Enty helps you stay compliant automatically by generating reports, syncing transactions, and handling VAT declarations — so you don’t have to worry about missing a deadline.

Do I need an accountant for my Estonian company?

It’s better to use a professional accountant, as all Estonian companies are legally required to maintain proper accounting and submit annual reports, even if they have no income or transactions. In many cases, VAT declarations and payroll reports may also be required monthly.

While technically you can try to handle it yourself, Estonian accounting standards are based on local GAAP, and errors can lead to fines, missed deadlines, or compliance issues.

That’s why most founders choose to work with a trusted accounting provider like Enty. Our platform automates data collection, helps you stay compliant, and eliminates manual paperwork.

Do I need an accountant for my Estonian company?

It’s better to use a professional accountant, as all Estonian companies are legally required to maintain proper accounting and submit annual reports, even if they have no income or transactions. In many cases, VAT declarations and payroll reports may also be required monthly.

While technically you can try to handle it yourself, Estonian accounting standards are based on local GAAP, and errors can lead to fines, missed deadlines, or compliance issues.

That’s why most founders choose to work with a trusted accounting provider like Enty. Our platform automates data collection, helps you stay compliant, and eliminates manual paperwork.

Do I need an accountant for my Estonian company?

It’s better to use a professional accountant, as all Estonian companies are legally required to maintain proper accounting and submit annual reports, even if they have no income or transactions. In many cases, VAT declarations and payroll reports may also be required monthly.

While technically you can try to handle it yourself, Estonian accounting standards are based on local GAAP, and errors can lead to fines, missed deadlines, or compliance issues.

That’s why most founders choose to work with a trusted accounting provider like Enty. Our platform automates data collection, helps you stay compliant, and eliminates manual paperwork.

When is the annual report due in Estonia?

All Estonian companies must submit their annual report to the Estonian Business Register by June 30 of the following year.

For example:

If your company operated in 2024, your annual report must be submitted by June 30, 2025.

The report must be prepared in accordance with Estonian accounting standards and filed digitally. Even if your company had no activity, the report is still mandatory.

Enty prepares and submits annual reports for you as part of our accounting services — ensuring you meet the deadline and avoid late penalties.

When is the annual report due in Estonia?

All Estonian companies must submit their annual report to the Estonian Business Register by June 30 of the following year.

For example:

If your company operated in 2024, your annual report must be submitted by June 30, 2025.

The report must be prepared in accordance with Estonian accounting standards and filed digitally. Even if your company had no activity, the report is still mandatory.

Enty prepares and submits annual reports for you as part of our accounting services — ensuring you meet the deadline and avoid late penalties.

When is the annual report due in Estonia?

All Estonian companies must submit their annual report to the Estonian Business Register by June 30 of the following year.

For example:

If your company operated in 2024, your annual report must be submitted by June 30, 2025.

The report must be prepared in accordance with Estonian accounting standards and filed digitally. Even if your company had no activity, the report is still mandatory.

Enty prepares and submits annual reports for you as part of our accounting services — ensuring you meet the deadline and avoid late penalties.

How does VAT in Estonia work?

In Estonia, Value Added Tax (VAT) is a standard part of doing business — and understanding how it works is essential for staying compliant.

Here’s how Estonian VAT works in a nutshell:

Standard VAT rate: 24%

Reduced rate: 13% and 9% (applies to certain goods and services like books, accommodation, etc.)

Do I need to register for VAT?

You must register for VAT in Estonia if:

Your annual turnover exceeds €40,000

You participate in OSS/IOSS schemes for EU-wide sales

You provide or receive certain types of cross-border services or goods

You can also register voluntarily, even below the threshold — for example, if you work with EU clients and want to reclaim input VAT.

How does VAT in Estonia work?

In Estonia, Value Added Tax (VAT) is a standard part of doing business — and understanding how it works is essential for staying compliant.

Here’s how Estonian VAT works in a nutshell:

Standard VAT rate: 24%

Reduced rate: 13% and 9% (applies to certain goods and services like books, accommodation, etc.)

Do I need to register for VAT?

You must register for VAT in Estonia if:

Your annual turnover exceeds €40,000

You participate in OSS/IOSS schemes for EU-wide sales

You provide or receive certain types of cross-border services or goods

You can also register voluntarily, even below the threshold — for example, if you work with EU clients and want to reclaim input VAT.

How does VAT in Estonia work?

In Estonia, Value Added Tax (VAT) is a standard part of doing business — and understanding how it works is essential for staying compliant.

Here’s how Estonian VAT works in a nutshell:

Standard VAT rate: 24%

Reduced rate: 13% and 9% (applies to certain goods and services like books, accommodation, etc.)

Do I need to register for VAT?

You must register for VAT in Estonia if:

Your annual turnover exceeds €40,000

You participate in OSS/IOSS schemes for EU-wide sales

You provide or receive certain types of cross-border services or goods

You can also register voluntarily, even below the threshold — for example, if you work with EU clients and want to reclaim input VAT.

Do I need to register for VAT in Estonia?

You must register for VAT in Estonia if your company meets any of the following conditions:

Your annual taxable turnover exceeds €40,000

You sell goods or services within the EU under the OSS/IOSS schemes

You provide or receive cross-border B2B services subject to reverse charge

You want to claim input VAT (many businesses register voluntarily for this reason)

Once registered, your company is required to:

Submit monthly VAT declarations

Keep proper VAT records

Charge VAT on taxable invoices (unless reverse-charged)

Enty handles the entire VAT registration process and manages your monthly VAT filings — so you never have to worry about changing rules or penalties.

Do I need to register for VAT in Estonia?

You must register for VAT in Estonia if your company meets any of the following conditions:

Your annual taxable turnover exceeds €40,000

You sell goods or services within the EU under the OSS/IOSS schemes

You provide or receive cross-border B2B services subject to reverse charge

You want to claim input VAT (many businesses register voluntarily for this reason)

Once registered, your company is required to:

Submit monthly VAT declarations

Keep proper VAT records

Charge VAT on taxable invoices (unless reverse-charged)

Enty handles the entire VAT registration process and manages your monthly VAT filings — so you never have to worry about changing rules or penalties.

Do I need to register for VAT in Estonia?

You must register for VAT in Estonia if your company meets any of the following conditions:

Your annual taxable turnover exceeds €40,000

You sell goods or services within the EU under the OSS/IOSS schemes

You provide or receive cross-border B2B services subject to reverse charge

You want to claim input VAT (many businesses register voluntarily for this reason)

Once registered, your company is required to:

Submit monthly VAT declarations

Keep proper VAT records

Charge VAT on taxable invoices (unless reverse-charged)

Enty handles the entire VAT registration process and manages your monthly VAT filings — so you never have to worry about changing rules or penalties.

How often do I need to file VAT reports in Estonia?

VAT-registered companies must:

Submit monthly VAT declarations

Pay VAT due on a monthly basis

Keep accurate and organized records of all invoices and transactions

Enty helps you register for VAT, file monthly reports, and stay fully compliant — whether you're operating locally or across EU borders.

How often do I need to file VAT reports in Estonia?

VAT-registered companies must:

Submit monthly VAT declarations

Pay VAT due on a monthly basis

Keep accurate and organized records of all invoices and transactions

Enty helps you register for VAT, file monthly reports, and stay fully compliant — whether you're operating locally or across EU borders.

How often do I need to file VAT reports in Estonia?

VAT-registered companies must:

Submit monthly VAT declarations

Pay VAT due on a monthly basis

Keep accurate and organized records of all invoices and transactions

Enty helps you register for VAT, file monthly reports, and stay fully compliant — whether you're operating locally or across EU borders.

What are OSS and IOSS schemes and how does it affect Estonian companies?

OSS (One-Stop Shop) and IOSS (Import One-Stop Shop) are EU-wide VAT schemes that simplify cross-border e-commerce and digital services.

OSS applies if you sell goods or services to consumers in other EU countries

IOSS is used for low-value goods imported from outside the EU and sold to EU consumers

If your Estonian company sells to EU customers, using OSS/IOSS can:

Help you avoid registering for VAT in multiple EU countries

Allow you to report and pay all EU VAT through a single Estonian declaration

Enty supports OSS/IOSS reporting and helps you stay compliant across all EU markets — especially helpful for e-commerce, SaaS, or digital service companies.

What are OSS and IOSS schemes and how does it affect Estonian companies?

OSS (One-Stop Shop) and IOSS (Import One-Stop Shop) are EU-wide VAT schemes that simplify cross-border e-commerce and digital services.

OSS applies if you sell goods or services to consumers in other EU countries

IOSS is used for low-value goods imported from outside the EU and sold to EU consumers

If your Estonian company sells to EU customers, using OSS/IOSS can:

Help you avoid registering for VAT in multiple EU countries

Allow you to report and pay all EU VAT through a single Estonian declaration

Enty supports OSS/IOSS reporting and helps you stay compliant across all EU markets — especially helpful for e-commerce, SaaS, or digital service companies.

What are OSS and IOSS schemes and how does it affect Estonian companies?

OSS (One-Stop Shop) and IOSS (Import One-Stop Shop) are EU-wide VAT schemes that simplify cross-border e-commerce and digital services.

OSS applies if you sell goods or services to consumers in other EU countries

IOSS is used for low-value goods imported from outside the EU and sold to EU consumers

If your Estonian company sells to EU customers, using OSS/IOSS can:

Help you avoid registering for VAT in multiple EU countries

Allow you to report and pay all EU VAT through a single Estonian declaration

Enty supports OSS/IOSS reporting and helps you stay compliant across all EU markets — especially helpful for e-commerce, SaaS, or digital service companies.

What if my Estonian company has no transactions — do I still need accounting?

Yes — even if your Estonian company has no income, expenses, or activity, you're still legally required to:

Maintain accounting records

Prepare and submit an annual report to the Estonian Business Register

Keep source documents (like invoices, contracts, and bank statements)

The Estonian authorities expect every registered company to meet basic compliance standards, regardless of activity level.

Enty offers accounting solutions for inactive companies, so you can stay compliant with minimal hassle.

What if my Estonian company has no transactions — do I still need accounting?

Yes — even if your Estonian company has no income, expenses, or activity, you're still legally required to:

Maintain accounting records

Prepare and submit an annual report to the Estonian Business Register

Keep source documents (like invoices, contracts, and bank statements)

The Estonian authorities expect every registered company to meet basic compliance standards, regardless of activity level.

Enty offers accounting solutions for inactive companies, so you can stay compliant with minimal hassle.

What if my Estonian company has no transactions — do I still need accounting?

Yes — even if your Estonian company has no income, expenses, or activity, you're still legally required to:

Maintain accounting records

Prepare and submit an annual report to the Estonian Business Register

Keep source documents (like invoices, contracts, and bank statements)

The Estonian authorities expect every registered company to meet basic compliance standards, regardless of activity level.

Enty offers accounting solutions for inactive companies, so you can stay compliant with minimal hassle.

Do I need to submit reports even if my company is inactive?

Yes, annual reports are mandatory for all Estonian companies, whether the company was actively trading during the year.

Even if your company had zero turnover, the report must still be submitted and it must reflect your company's inactive status correctly in line with Estonian GAAP.

Missing or skipping the report can lead to:

Fines from the Estonian Business Register

Forced liquidation of your company

Enty makes it easy to file inactive reports properly and on time — so you don’t risk penalties or complications.

Do I need to submit reports even if my company is inactive?

Yes, annual reports are mandatory for all Estonian companies, whether the company was actively trading during the year.

Even if your company had zero turnover, the report must still be submitted and it must reflect your company's inactive status correctly in line with Estonian GAAP.

Missing or skipping the report can lead to:

Fines from the Estonian Business Register

Forced liquidation of your company

Enty makes it easy to file inactive reports properly and on time — so you don’t risk penalties or complications.

Do I need to submit reports even if my company is inactive?

Yes, annual reports are mandatory for all Estonian companies, whether the company was actively trading during the year.

Even if your company had zero turnover, the report must still be submitted and it must reflect your company's inactive status correctly in line with Estonian GAAP.

Missing or skipping the report can lead to:

Fines from the Estonian Business Register

Forced liquidation of your company

Enty makes it easy to file inactive reports properly and on time — so you don’t risk penalties or complications.

Can I do accounting myself for my Estonian company?

Technically, yes — you can manage accounting on your own if you're familiar with Estonian GAAP, VAT rules, reporting software, and local filing standards.

However, in practice:

All reports must be filed in Estonian

Mistakes can lead to penalties, audits, or non-compliance

Monthly VAT and payroll declarations require local expertise

That’s why most founders — especially those operating remotely — delegate accounting to a professional service.

Enty combines automation with expert support to handle your accounting, filings, and deadlines — with clear pricing and no hidden fees.

Can I do accounting myself for my Estonian company?

Technically, yes — you can manage accounting on your own if you're familiar with Estonian GAAP, VAT rules, reporting software, and local filing standards.

However, in practice:

All reports must be filed in Estonian

Mistakes can lead to penalties, audits, or non-compliance

Monthly VAT and payroll declarations require local expertise

That’s why most founders — especially those operating remotely — delegate accounting to a professional service.

Enty combines automation with expert support to handle your accounting, filings, and deadlines — with clear pricing and no hidden fees.

Can I do accounting myself for my Estonian company?

Technically, yes — you can manage accounting on your own if you're familiar with Estonian GAAP, VAT rules, reporting software, and local filing standards.

However, in practice:

All reports must be filed in Estonian

Mistakes can lead to penalties, audits, or non-compliance

Monthly VAT and payroll declarations require local expertise

That’s why most founders — especially those operating remotely — delegate accounting to a professional service.

Enty combines automation with expert support to handle your accounting, filings, and deadlines — with clear pricing and no hidden fees.

What accounting services do you provide?

Enty offers a full range of accounting services for Estonian companies, whether you're just starting out or scaling fast. Our team handles both ongoing and one-time accounting needs, including:

Annual reports (required for all Estonian companies)

Monthly VAT declarations (standard and OSS/IOSS schemes)

Payroll processing and tax declarations

One-off accounting — for example, submitting reports for past periods or clearing up old obligations

Tailored financial reports, investor-ready summaries, and bookkeeping cleanups

You can choose between subscription plans (for ongoing support) or on-demand services as needed. Either way, we help you stay compliant and audit-ready — without the accounting headache.

What accounting services do you provide?

Enty offers a full range of accounting services for Estonian companies, whether you're just starting out or scaling fast. Our team handles both ongoing and one-time accounting needs, including:

Annual reports (required for all Estonian companies)

Monthly VAT declarations (standard and OSS/IOSS schemes)

Payroll processing and tax declarations

One-off accounting — for example, submitting reports for past periods or clearing up old obligations

Tailored financial reports, investor-ready summaries, and bookkeeping cleanups

You can choose between subscription plans (for ongoing support) or on-demand services as needed. Either way, we help you stay compliant and audit-ready — without the accounting headache.

What accounting services do you provide?

Enty offers a full range of accounting services for Estonian companies, whether you're just starting out or scaling fast. Our team handles both ongoing and one-time accounting needs, including:

Annual reports (required for all Estonian companies)

Monthly VAT declarations (standard and OSS/IOSS schemes)

Payroll processing and tax declarations

One-off accounting — for example, submitting reports for past periods or clearing up old obligations

Tailored financial reports, investor-ready summaries, and bookkeeping cleanups

You can choose between subscription plans (for ongoing support) or on-demand services as needed. Either way, we help you stay compliant and audit-ready — without the accounting headache.

What accounting services are included in your subscription plans?

If you opt for the Monthly accounting Plan or the Ecom Plan, Enty will submit your monthly VAT declarations starting from the next month from the date you subscribed, as well as the annual report at the end of the year (subject to additional charges if you joined Enty after February of each year).

If you choose the Annual accounting plan, Enty will submit the annual report for your company. The annual report is included in the subscription price if Enty has received payment for at least 10 months of the year. So, if your payments cover fewer periods (basically, if you signed up after February and you opted to be charged on a monthly basis), you should pay extra - €59 per each missing month.

All the plans also include 1 payroll declaration per month.

What accounting services are included in your subscription plans?

If you opt for the Monthly accounting Plan or the Ecom Plan, Enty will submit your monthly VAT declarations starting from the next month from the date you subscribed, as well as the annual report at the end of the year (subject to additional charges if you joined Enty after February of each year).

If you choose the Annual accounting plan, Enty will submit the annual report for your company. The annual report is included in the subscription price if Enty has received payment for at least 10 months of the year. So, if your payments cover fewer periods (basically, if you signed up after February and you opted to be charged on a monthly basis), you should pay extra - €59 per each missing month.

All the plans also include 1 payroll declaration per month.

What accounting services are included in your subscription plans?

If you opt for the Monthly accounting Plan or the Ecom Plan, Enty will submit your monthly VAT declarations starting from the next month from the date you subscribed, as well as the annual report at the end of the year (subject to additional charges if you joined Enty after February of each year).

If you choose the Annual accounting plan, Enty will submit the annual report for your company. The annual report is included in the subscription price if Enty has received payment for at least 10 months of the year. So, if your payments cover fewer periods (basically, if you signed up after February and you opted to be charged on a monthly basis), you should pay extra - €59 per each missing month.

All the plans also include 1 payroll declaration per month.

How do I find a suitable accounting plan for my Estonian company?

Choosing the right plan depends on your business activity, transaction volume, and whether you're VAT-registered. Here's a quick guide:

🟢 Annual Reporting Plan — for low or no activity

Best suited if your company:

Doesn’t have a VAT number

Is in the product development phase (no sales yet)

Functions as a holding or dormant company

🟠 E-commerce Plan — for online sales platforms

Choose this if your company:

Sells through platforms like Shopify, WooCommerce, Amazon

Uses payment gateways like Stripe, PayPal, Wise, Revolut Business

Needs to sync sales data from multiple sources

🔵 Monthly Reporting Plan — for active, VAT-registered businesses

Recommended if your company:

Has recurring sales or expenses

Is VAT-registered and needs to submit monthly VAT returns

Operates as a service provider, agency, SaaS business, or consultancy

Still not sure which plan fits best? Book a free call and we’ll help you choose the right one.

How do I find a suitable accounting plan for my Estonian company?

Choosing the right plan depends on your business activity, transaction volume, and whether you're VAT-registered. Here's a quick guide:

🟢 Annual Reporting Plan — for low or no activity

Best suited if your company:

Doesn’t have a VAT number

Is in the product development phase (no sales yet)

Functions as a holding or dormant company

🟠 E-commerce Plan — for online sales platforms

Choose this if your company:

Sells through platforms like Shopify, WooCommerce, Amazon

Uses payment gateways like Stripe, PayPal, Wise, Revolut Business

Needs to sync sales data from multiple sources

🔵 Monthly Reporting Plan — for active, VAT-registered businesses

Recommended if your company:

Has recurring sales or expenses

Is VAT-registered and needs to submit monthly VAT returns

Operates as a service provider, agency, SaaS business, or consultancy

Still not sure which plan fits best? Book a free call and we’ll help you choose the right one.

How do I find a suitable accounting plan for my Estonian company?

Choosing the right plan depends on your business activity, transaction volume, and whether you're VAT-registered. Here's a quick guide:

🟢 Annual Reporting Plan — for low or no activity

Best suited if your company:

Doesn’t have a VAT number

Is in the product development phase (no sales yet)

Functions as a holding or dormant company

🟠 E-commerce Plan — for online sales platforms

Choose this if your company:

Sells through platforms like Shopify, WooCommerce, Amazon

Uses payment gateways like Stripe, PayPal, Wise, Revolut Business

Needs to sync sales data from multiple sources

🔵 Monthly Reporting Plan — for active, VAT-registered businesses

Recommended if your company:

Has recurring sales or expenses

Is VAT-registered and needs to submit monthly VAT returns

Operates as a service provider, agency, SaaS business, or consultancy