Estonian annual report filed for you. On time.

Your annual report, prepared by professional accountants. Fast and fully online.

Estonian annual report filed for you. On time.

Your annual report, prepared by professional accountants. Fast and fully online.

Estonian annual report filed for you. On time.

Your annual report, prepared by professional accountants. Fast and fully online.

Filing the report is mandatory

Filing an annual report in Estonia is mandatory for all companies, even if there is no activity. Missing the deadline may lead to fines or forced liquidation.

Enty makes it simple and safe, so you stay compliant with no stress

Filing the report is mandatory

Filing an annual report in Estonia is mandatory for all companies, even if there is no activity. Missing the deadline may lead to fines or forced liquidation.

Enty makes it simple and safe, so you stay compliant with no stress

Filing the report is mandatory

Filing an annual report in Estonia is mandatory for all companies, even if there is no activity. Missing the deadline may lead to fines or forced liquidation.

Enty makes it simple and safe, so you stay compliant with no stress

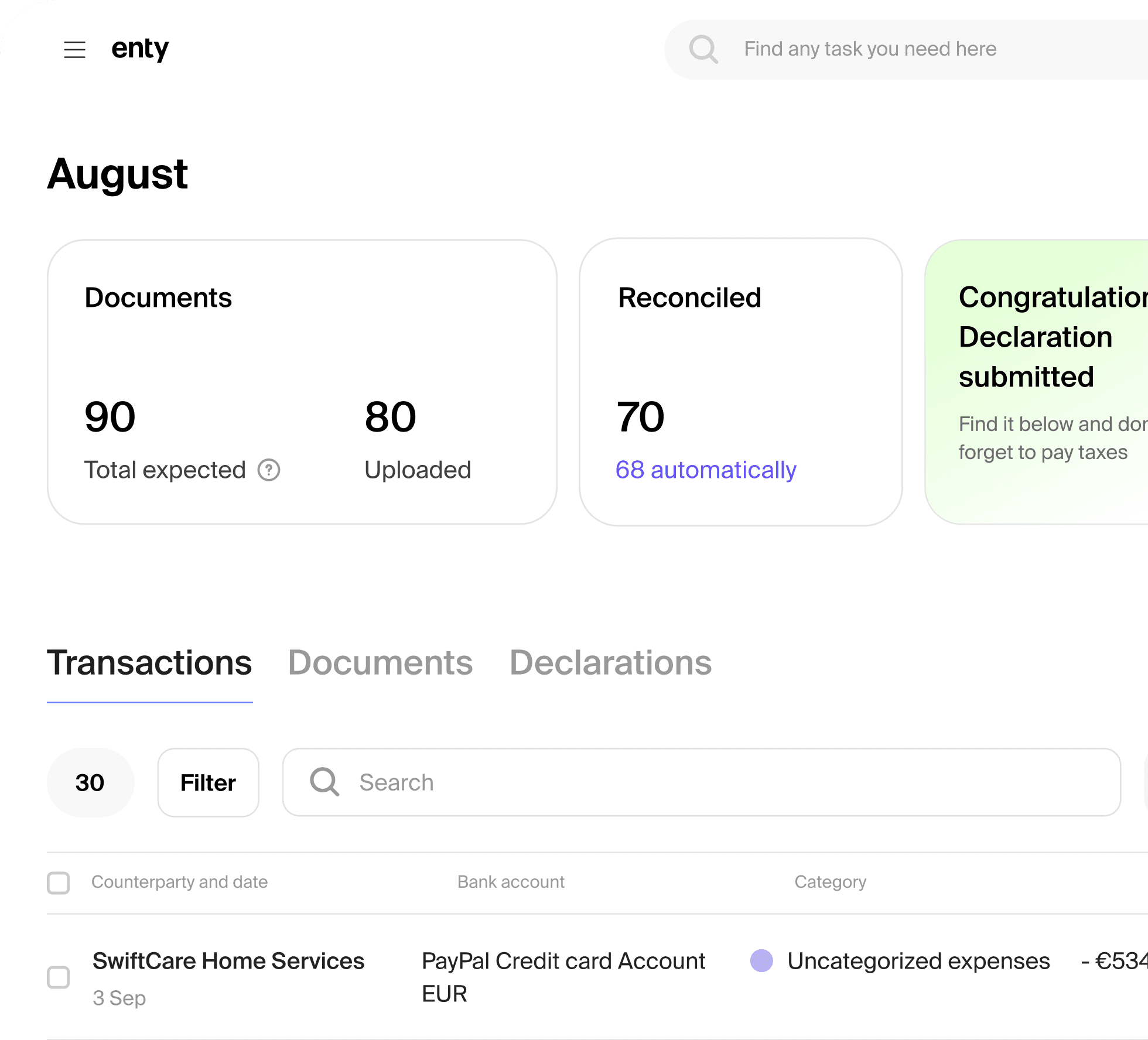

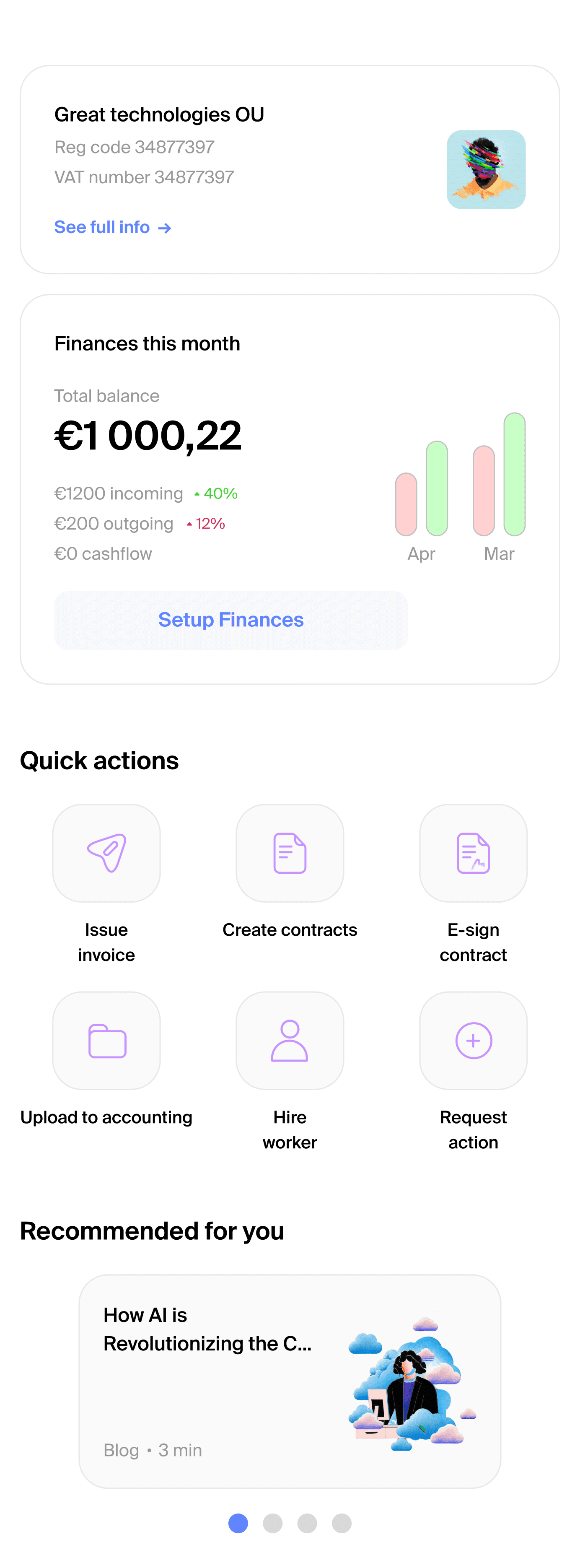

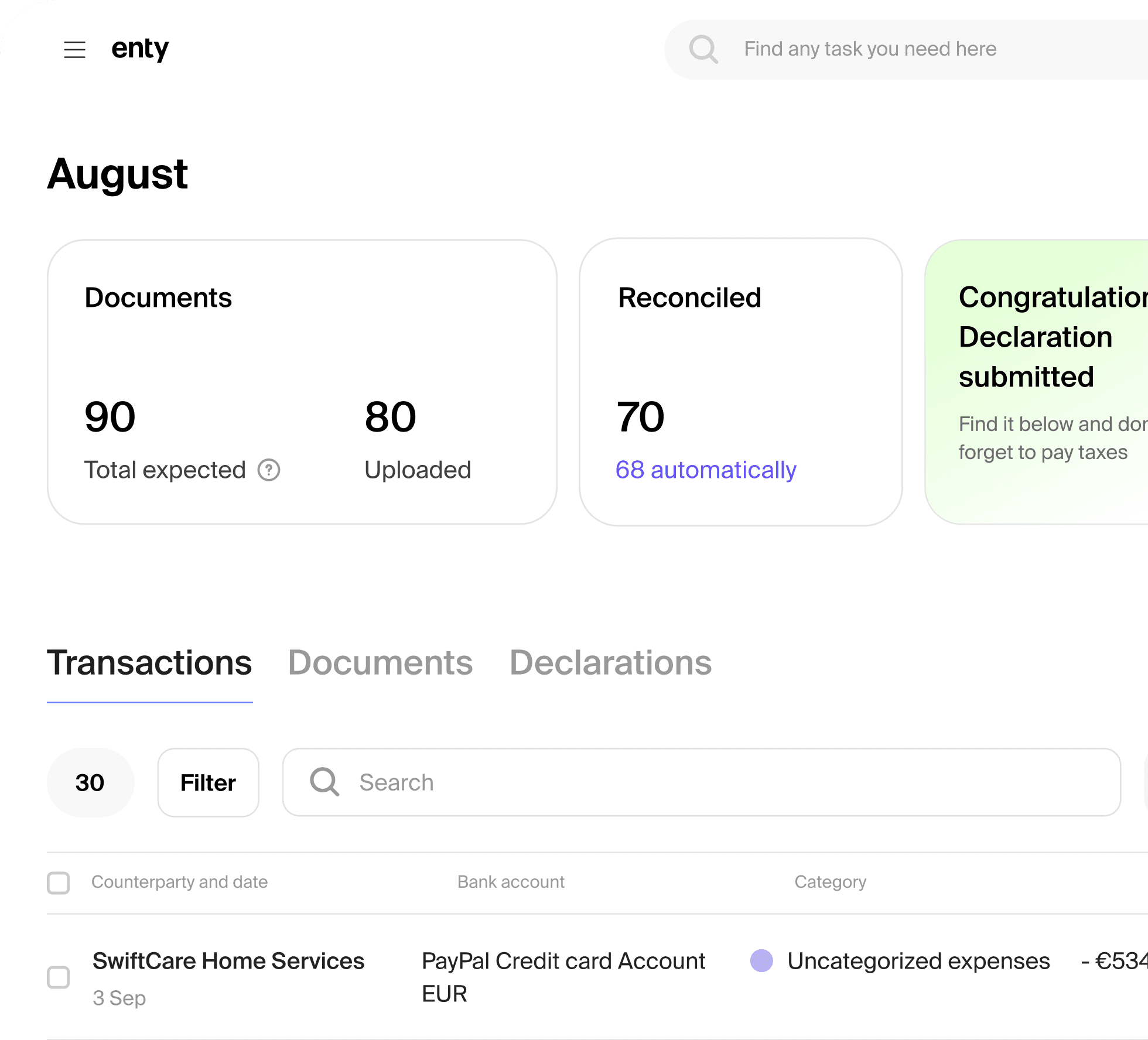

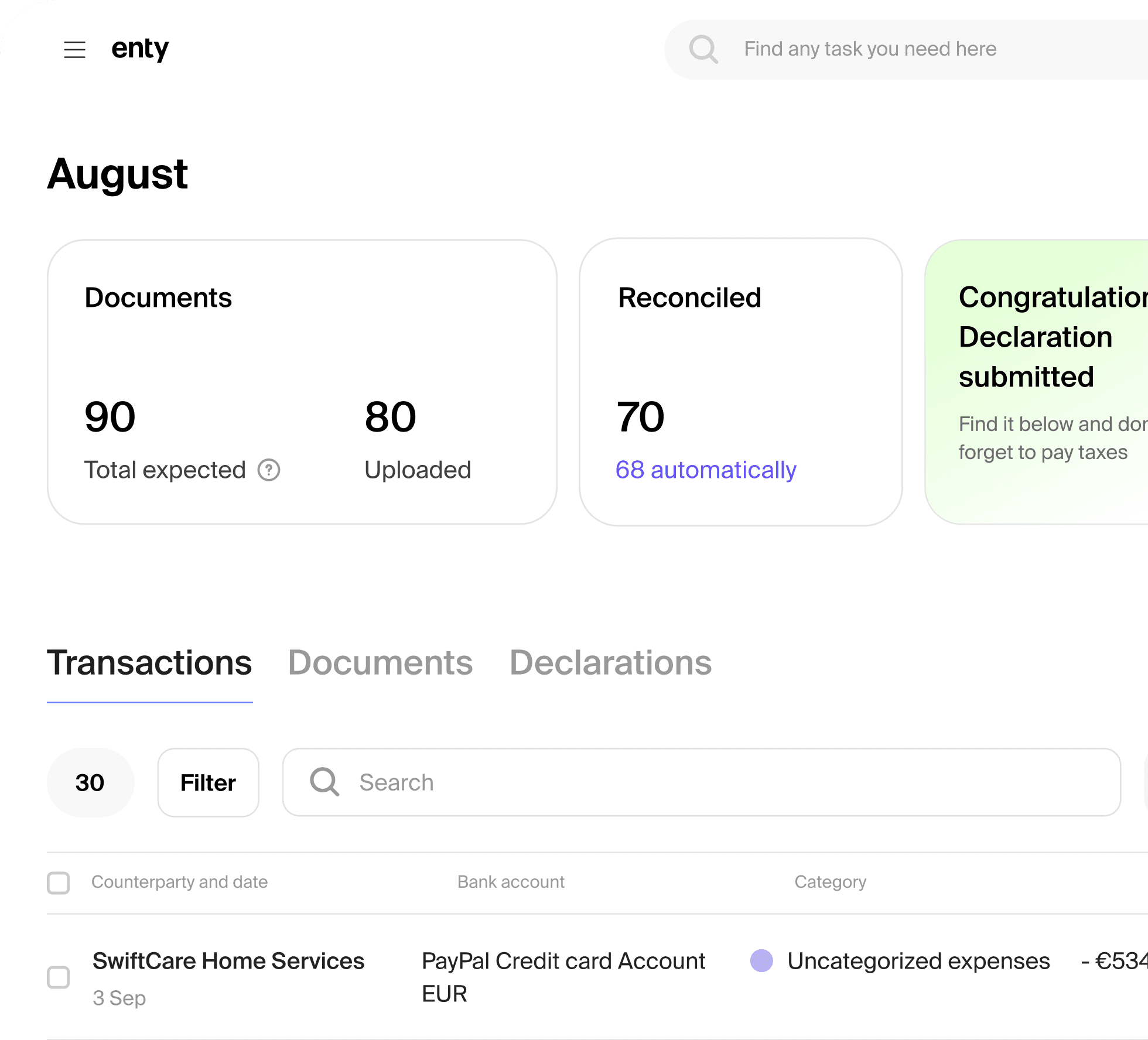

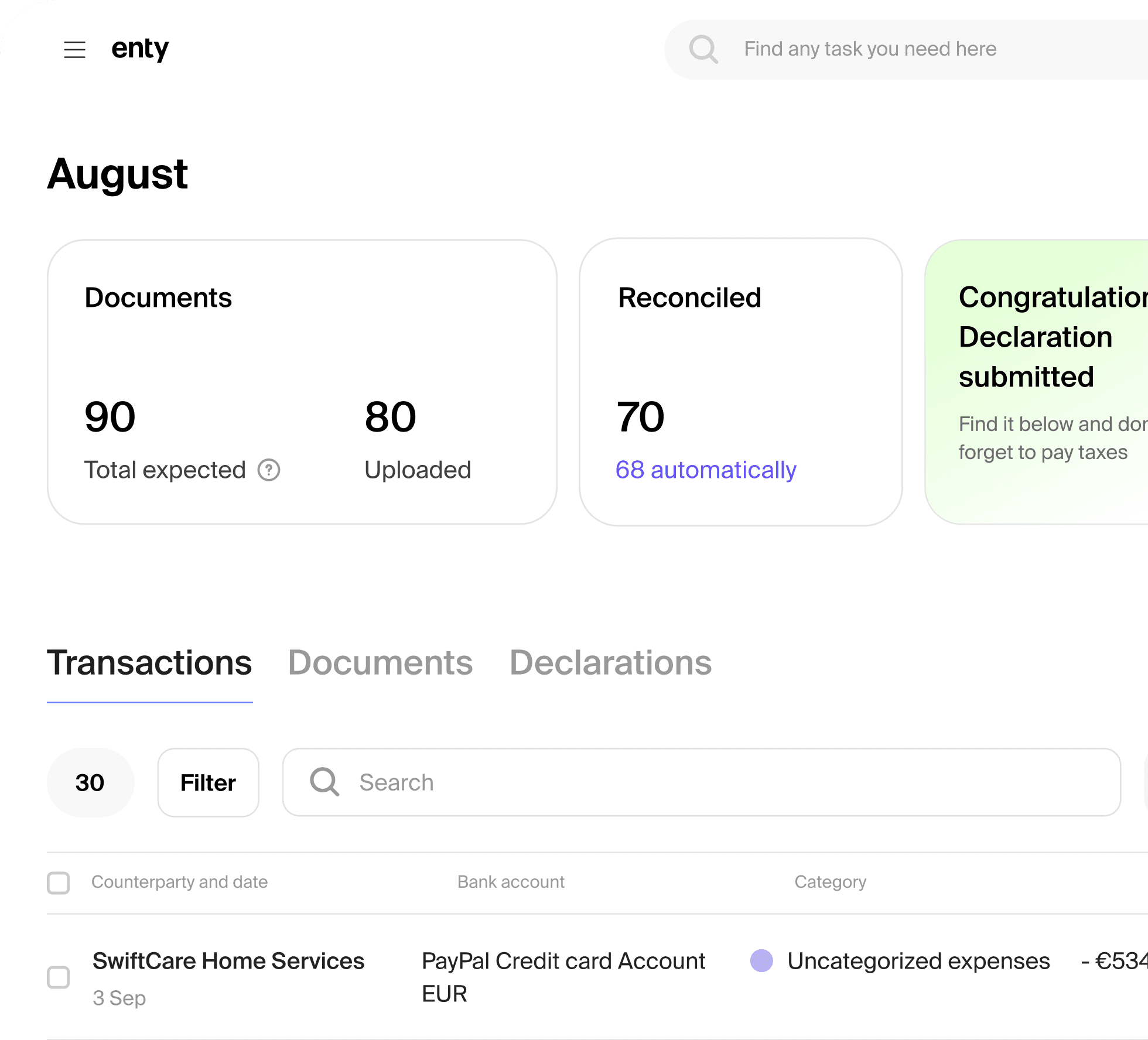

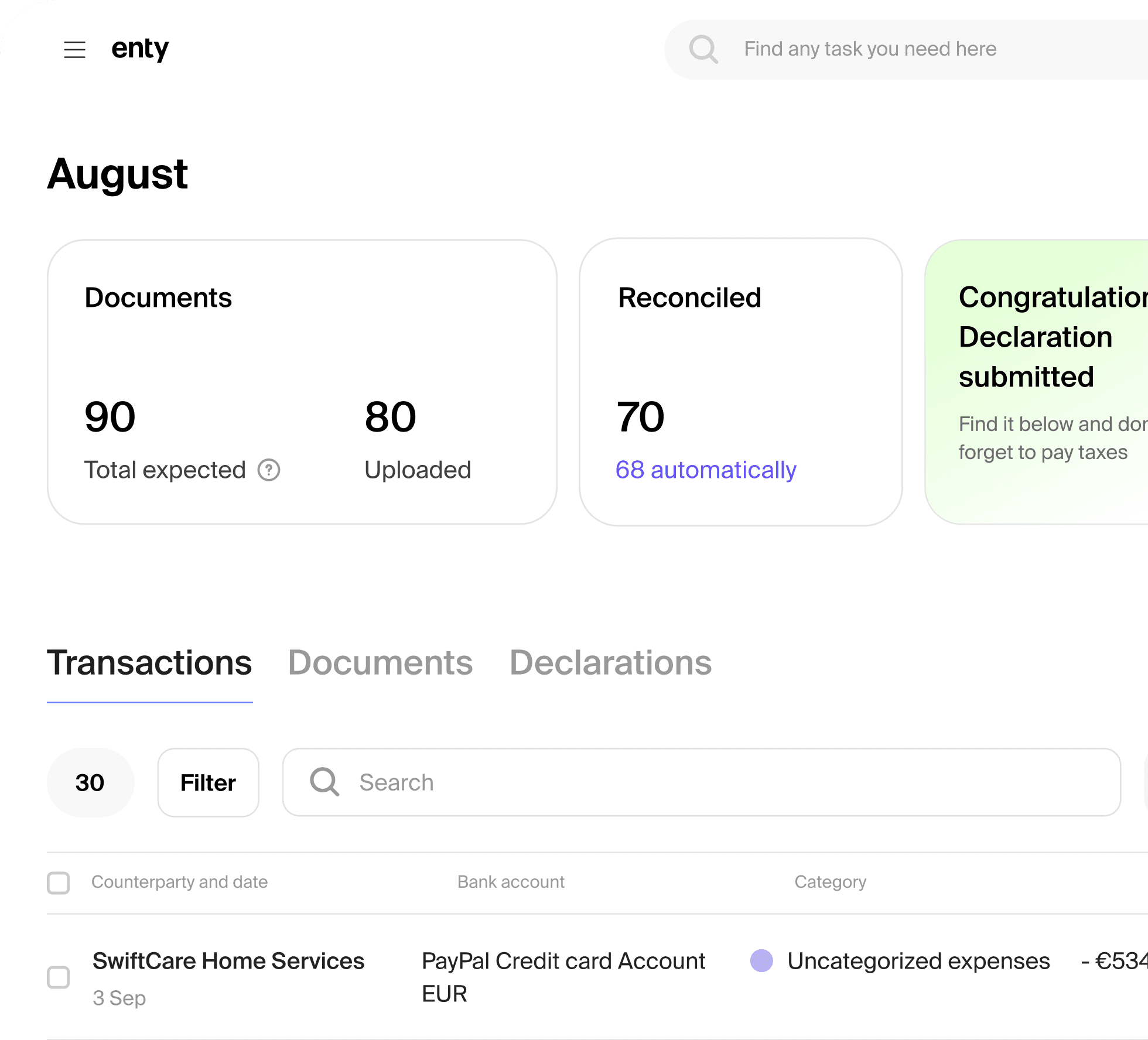

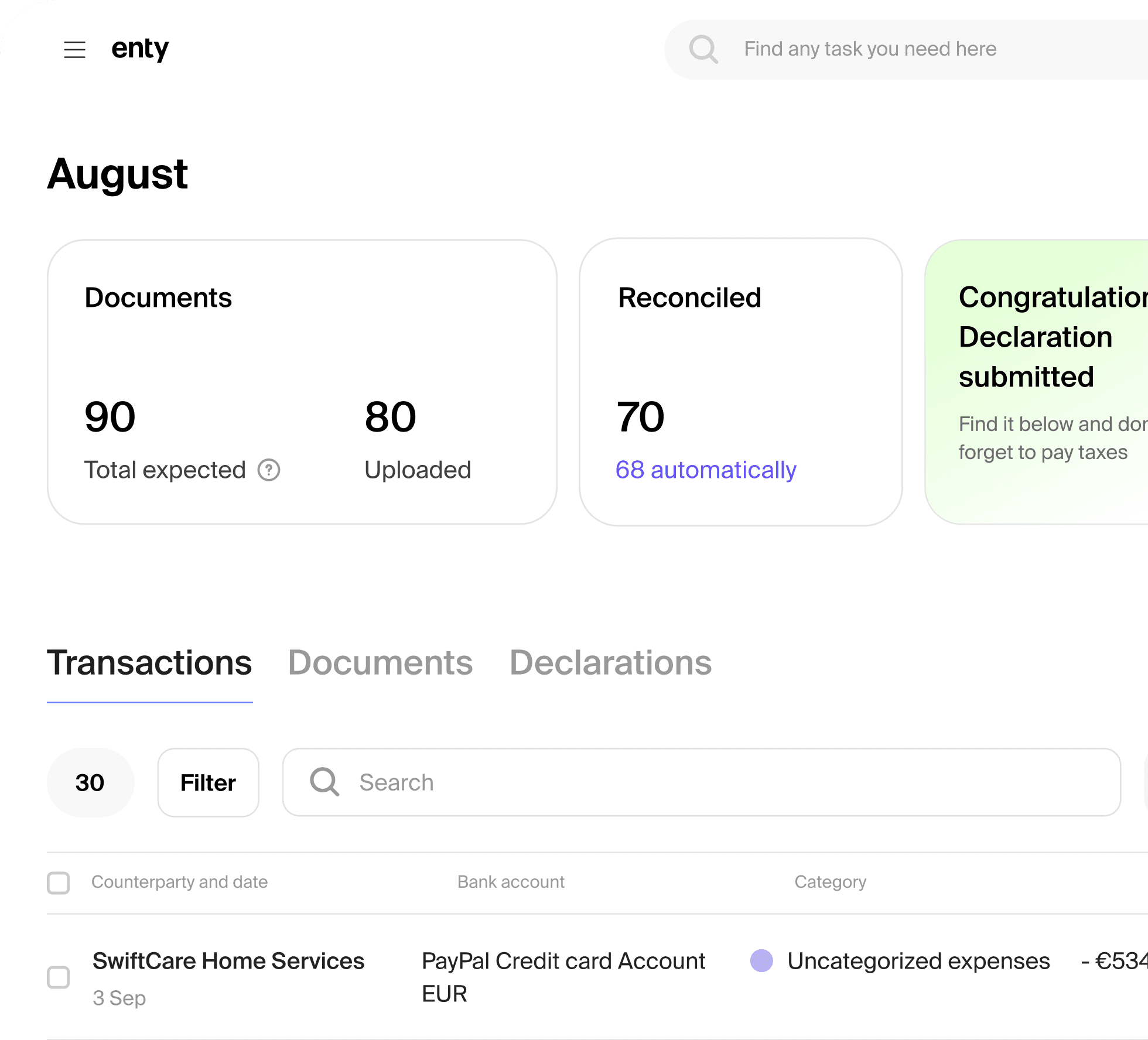

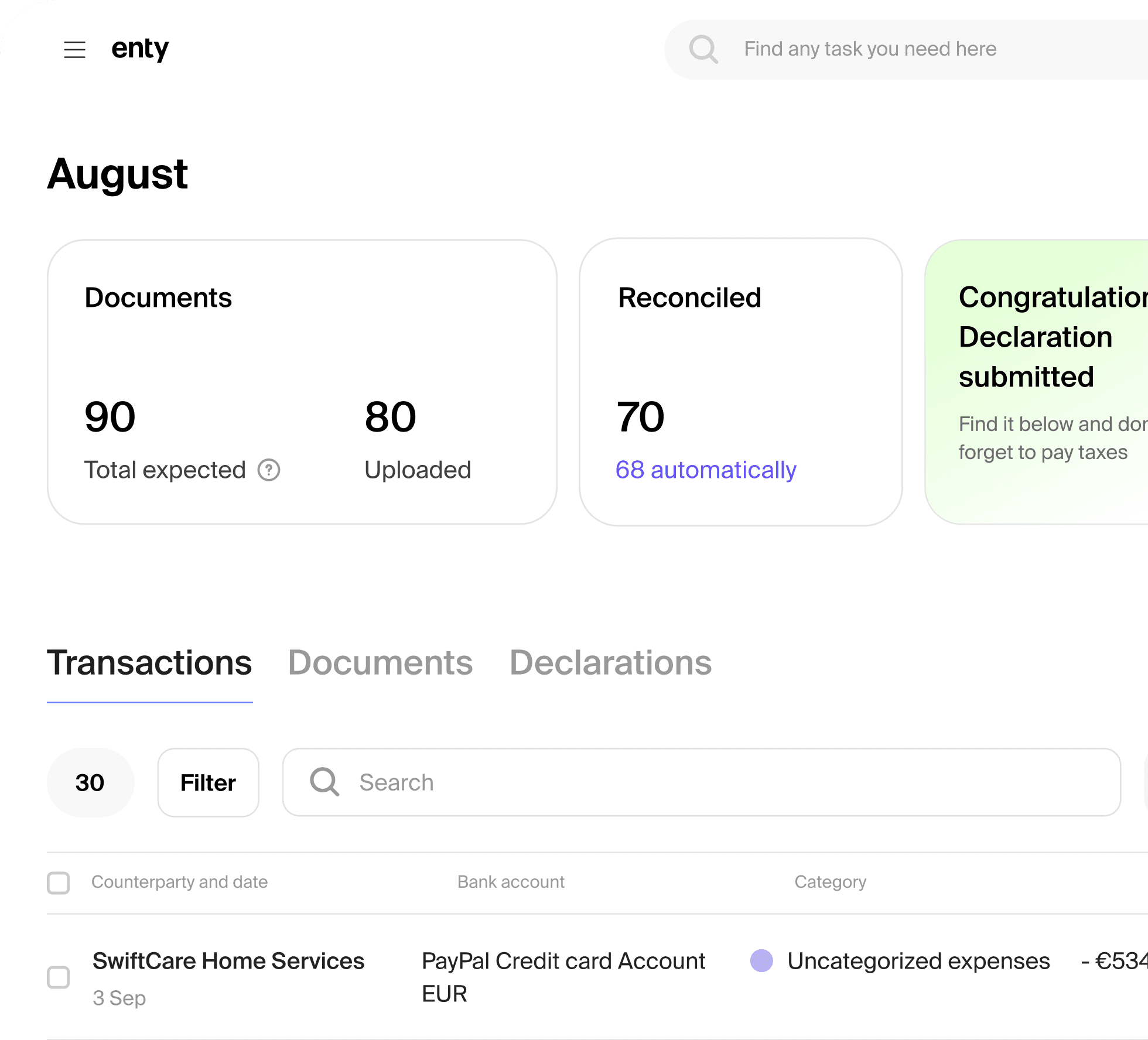

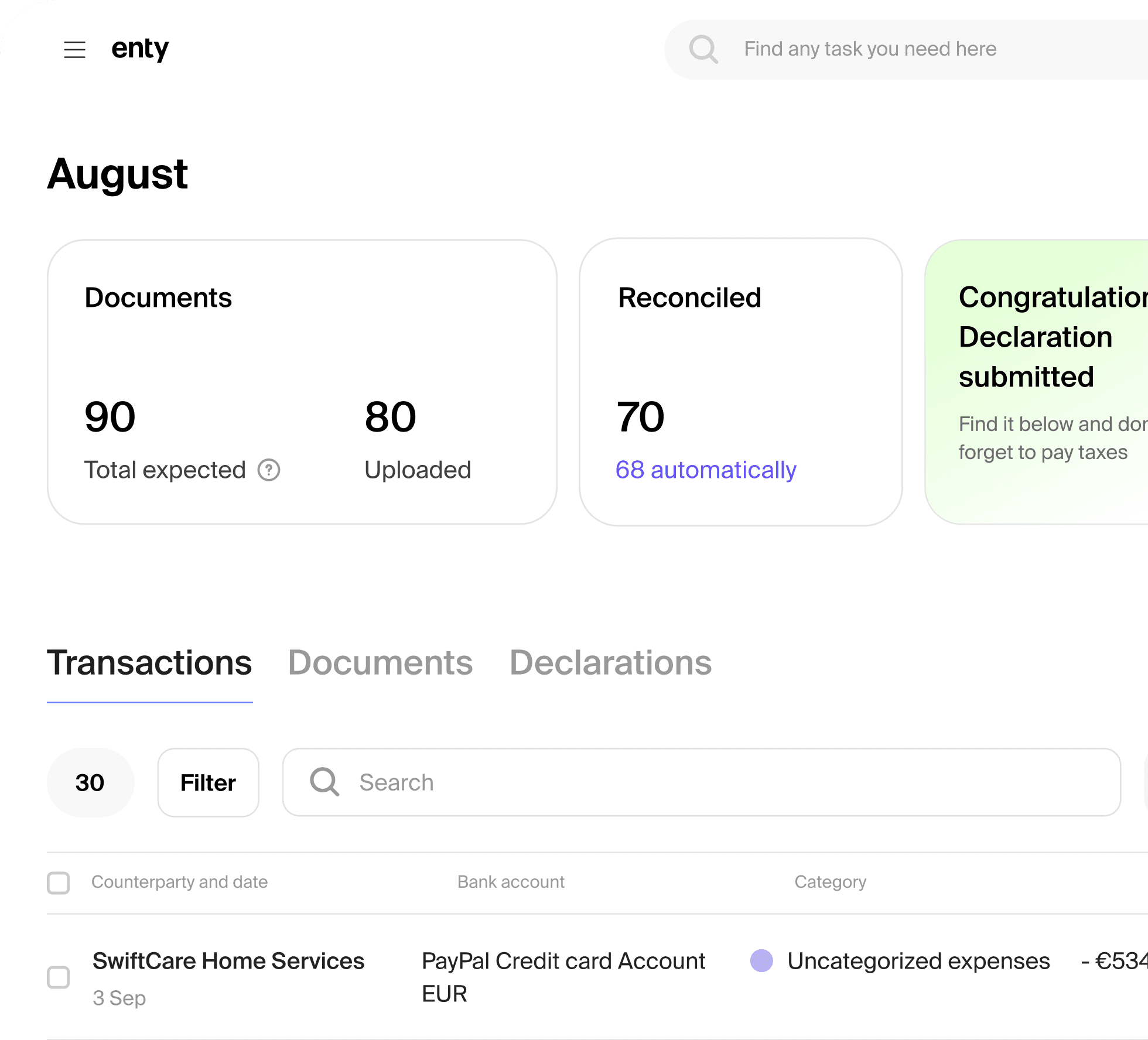

How it works

Leave a request

Get clear instructions by email

Upload bank statements and invoices on our platform

We prepare and submit your annual report

How it works

Leave a request

Get clear instructions by email

Upload bank statements and invoices on our platform

We prepare and submit your annual report

How it works

Leave a request

Get clear instructions by email

Upload bank statements and invoices on our platform

We prepare and submit your annual report

Leave a request before 1 March 2026 and get the early bird price!

Leave a request before 1 March 2026 and get the early bird price!

No accounting knowledge needed.

We guide you at every step.

No accounting knowledge needed.

We guide you at every step.

No accounting knowledge needed.

We guide you at every step.

5 years in Estonia. 5.000 annual reports submitted

5 years in Estonia. 5.000 annual reports submitted

5 years in Estonia. 5.000 annual reports submitted

Professional accountants by your side

Professional accountants by your side

Professional accountants by your side

Fast, secure, and transparent process

Fast, secure, and transparent process

Fast, secure, and transparent process

Direct submission to the Estonian Business Register

Direct submission to the Estonian Business Register

Direct submission to the Estonian Business Register

Early bird pricing before 1/03/26

Early bird pricing before 1/03/26

Early bird pricing before 1/03/26

* Documents are usually bank statements and supporting documents such as invoices, contracts, or agreements that explain money movements

* Documents are usually bank statements and supporting documents such as invoices, contracts, or agreements that explain money movements

* Documents are usually bank statements and supporting documents such as invoices, contracts, or agreements that explain money movements

Get your annual report done today – don't risk fines or company liquidation

Get your annual report done today – don't risk fines or company liquidation

Get your annual report done today – don't risk fines or company liquidation

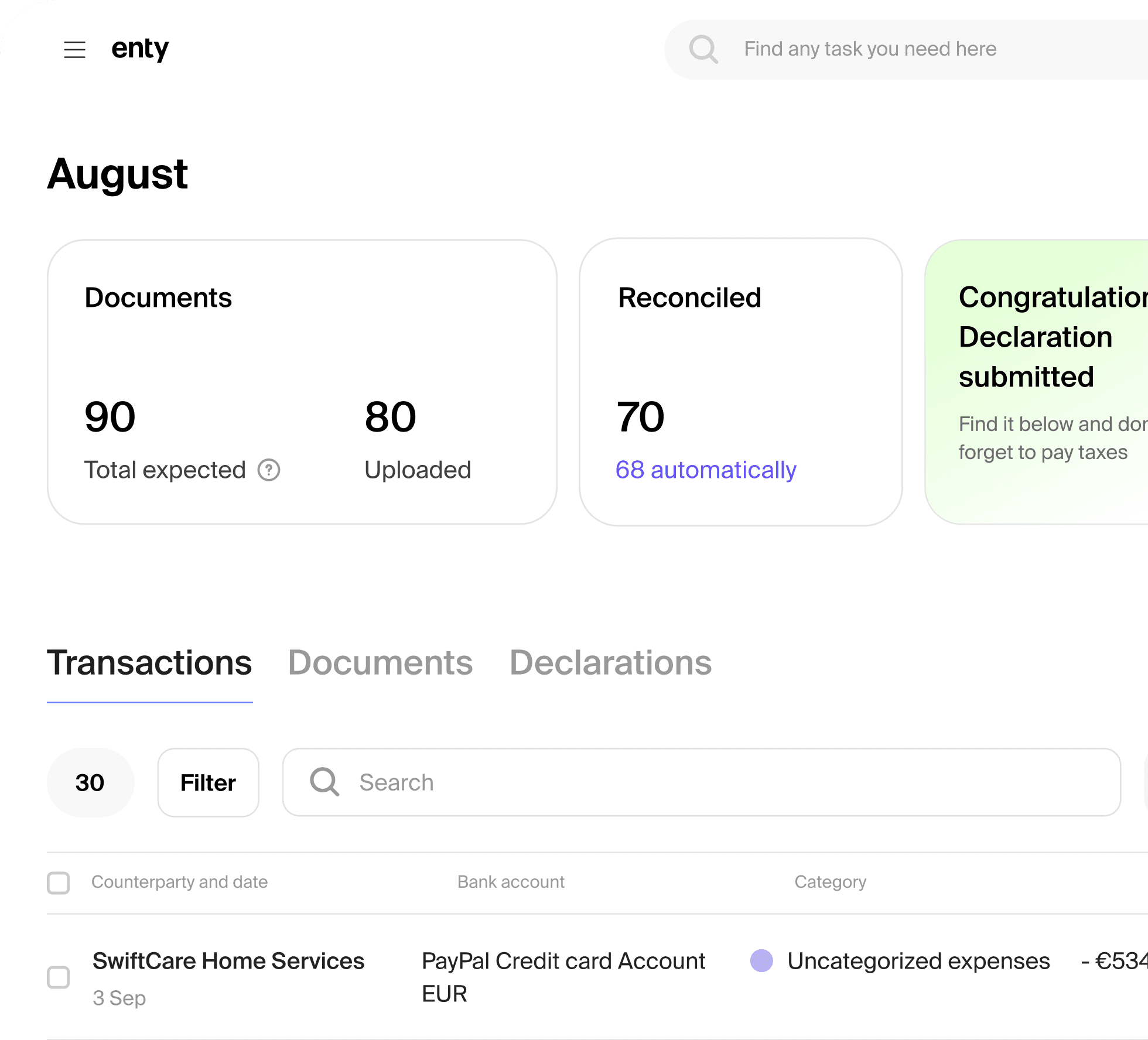

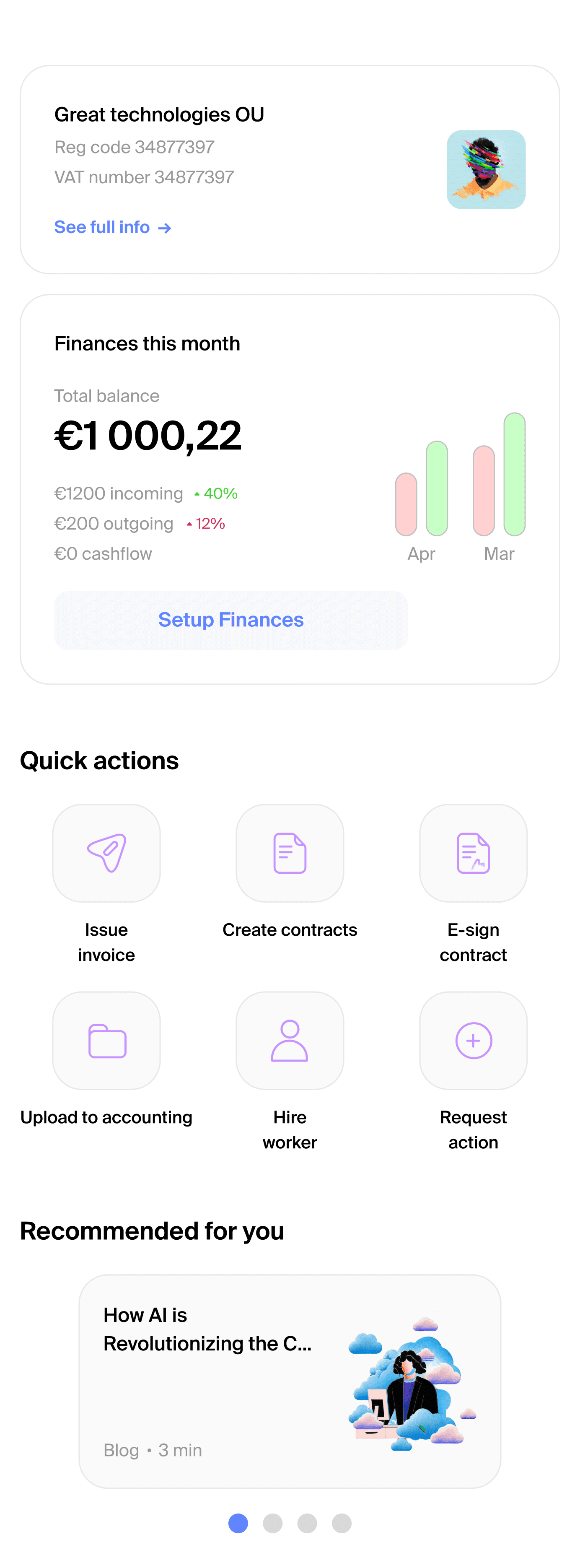

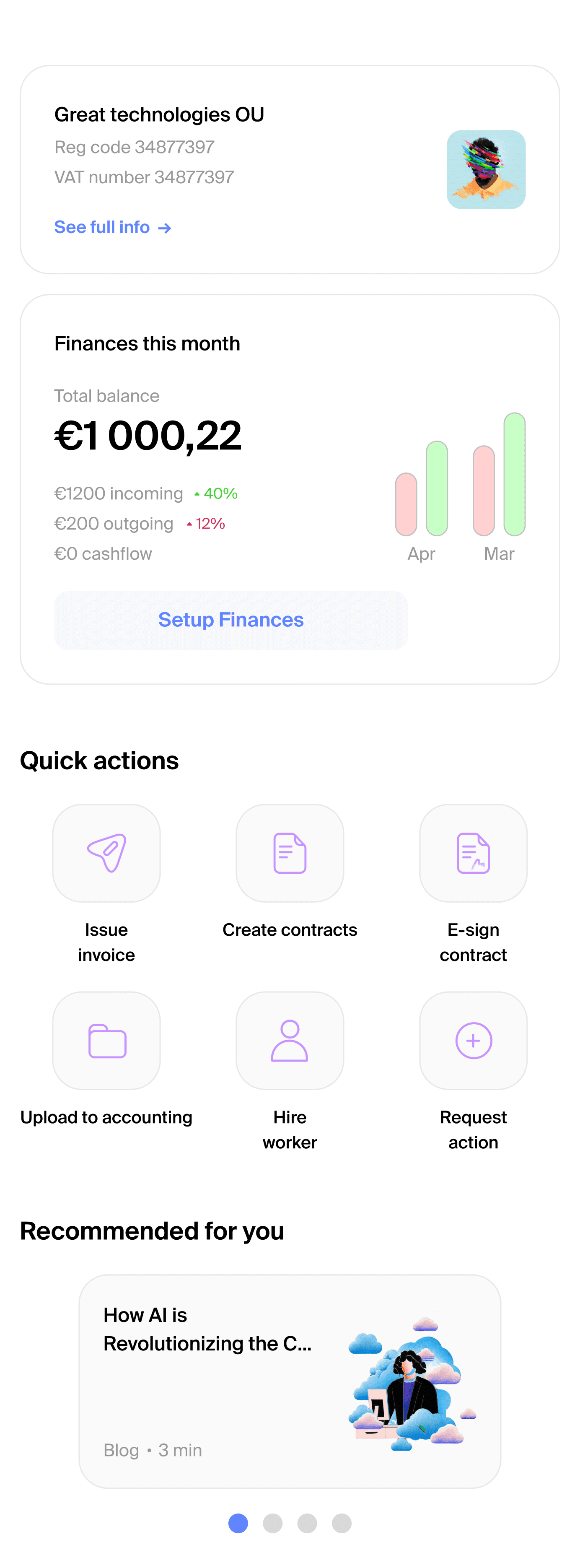

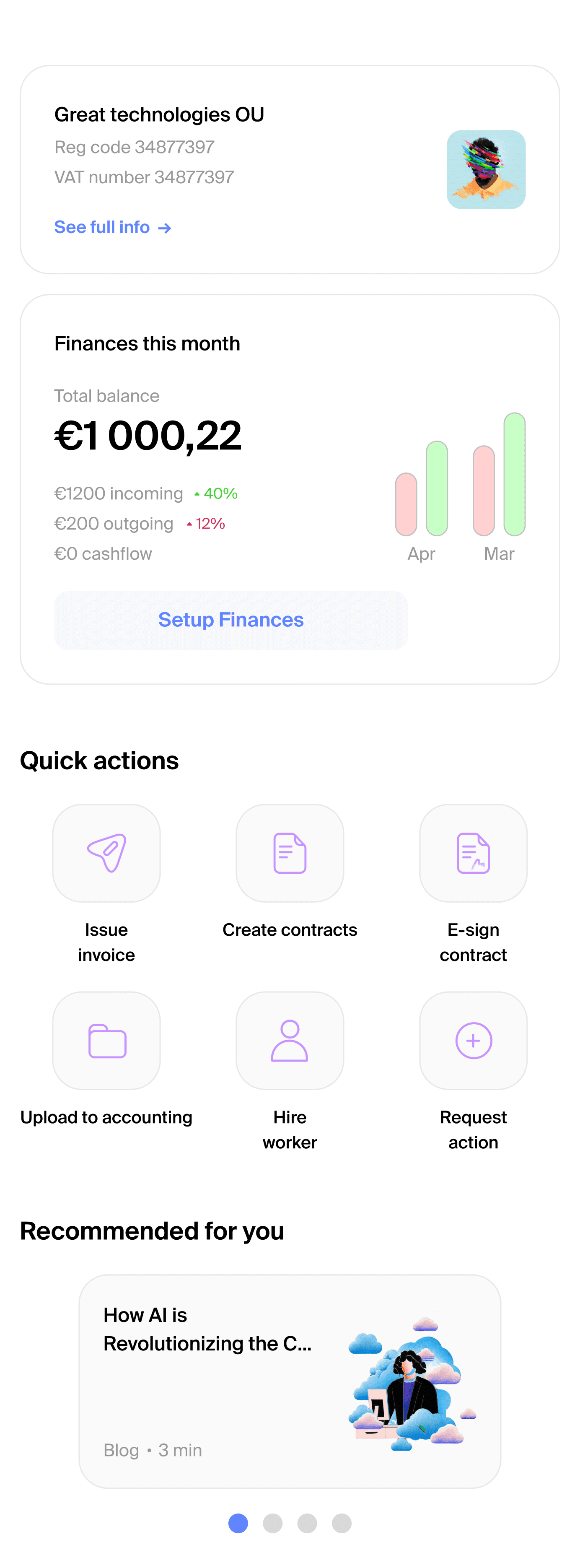

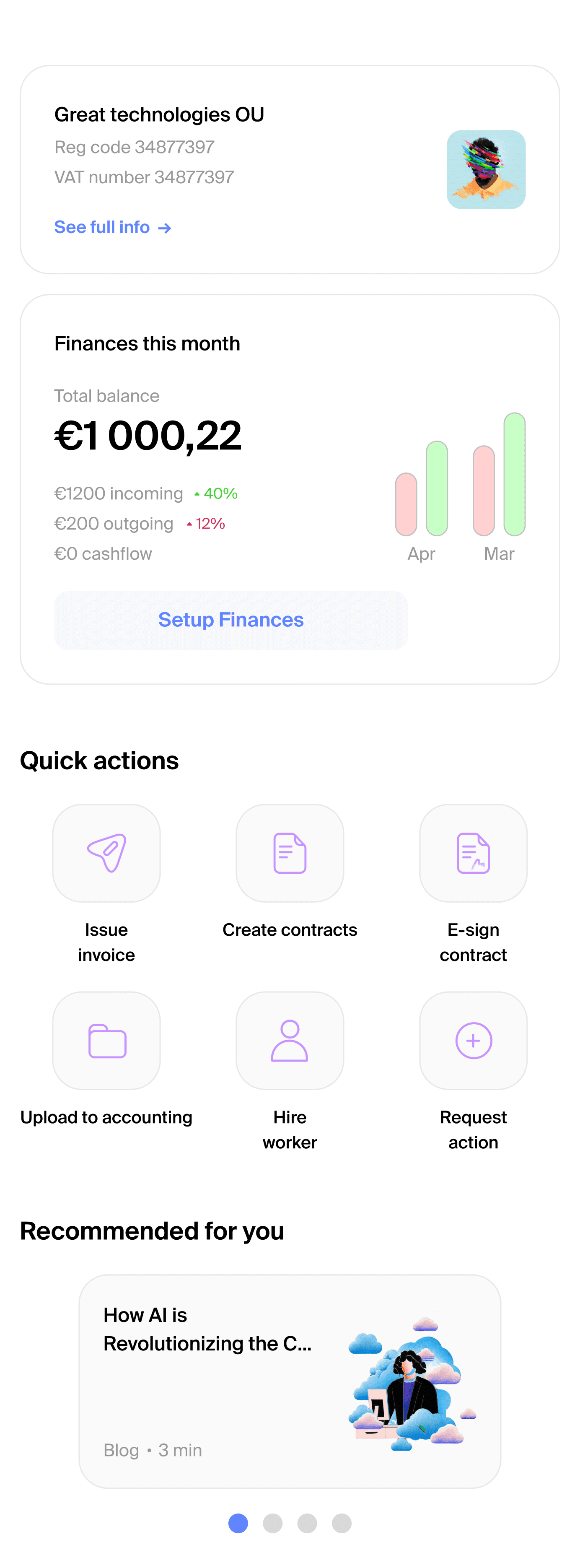

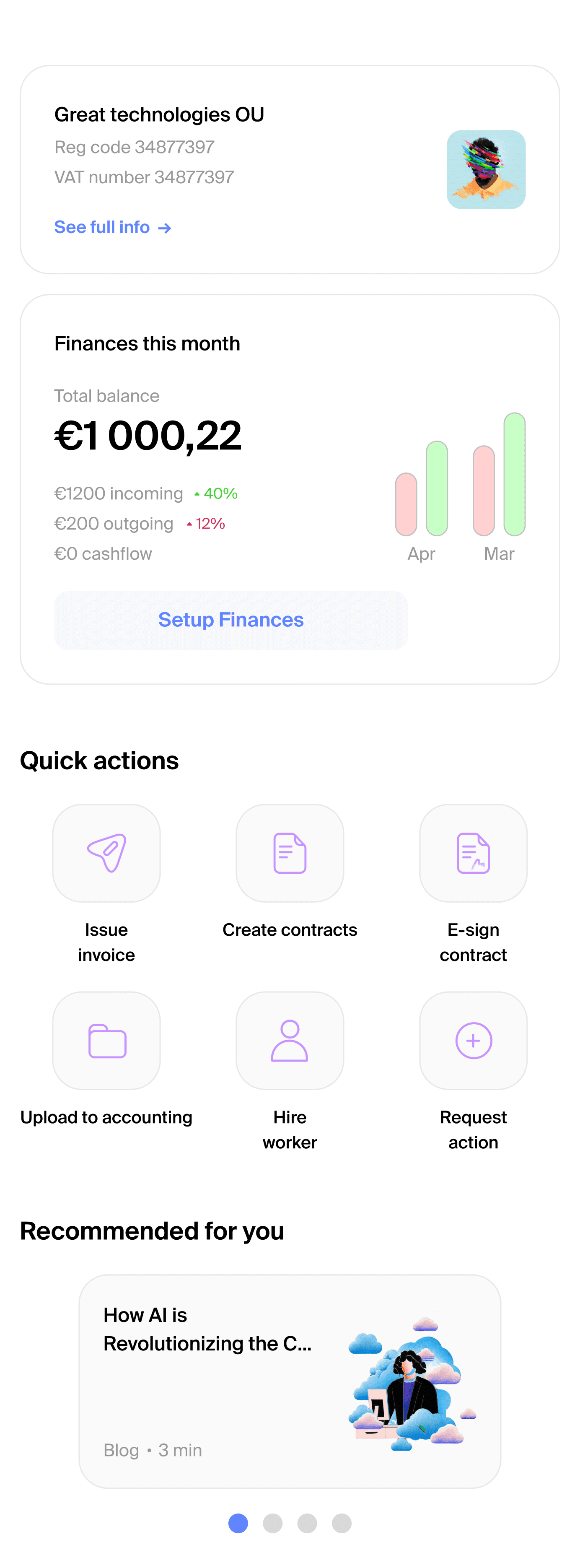

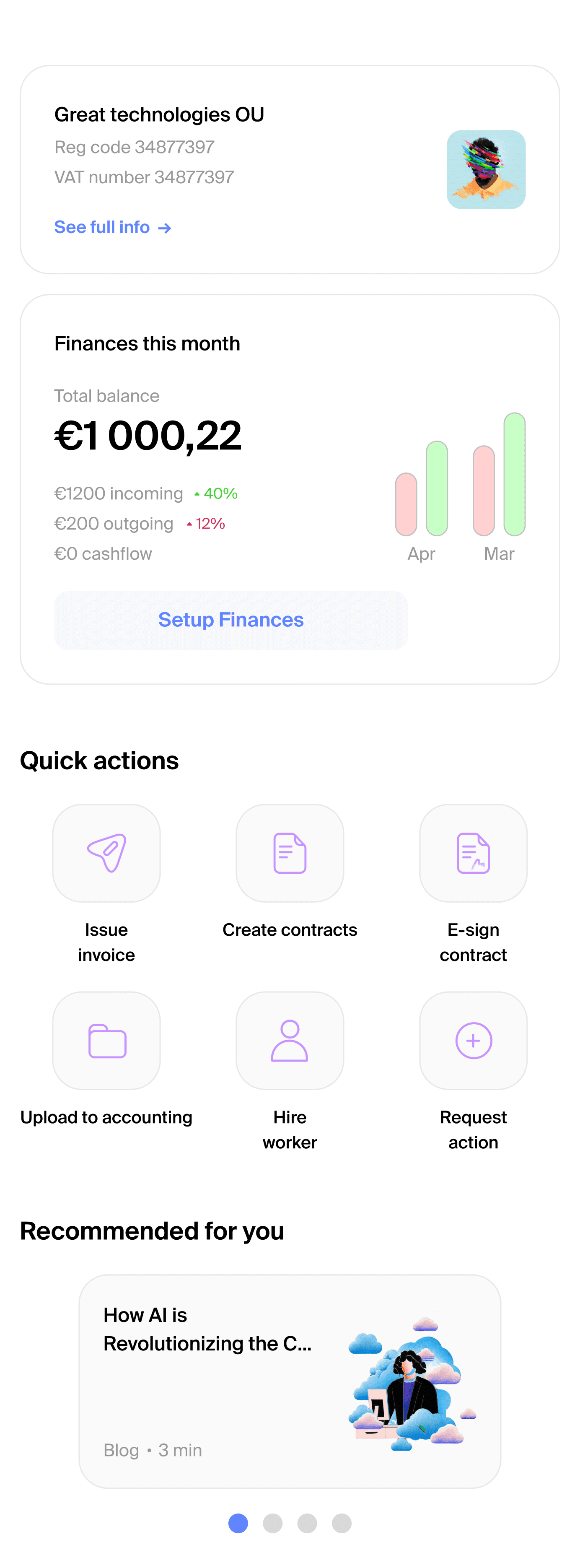

With our Accounting subscription, your annual report is handled automatically every year

With our Accounting subscription, your annual report is handled automatically every year

With our Accounting subscription, your annual report is handled automatically every year

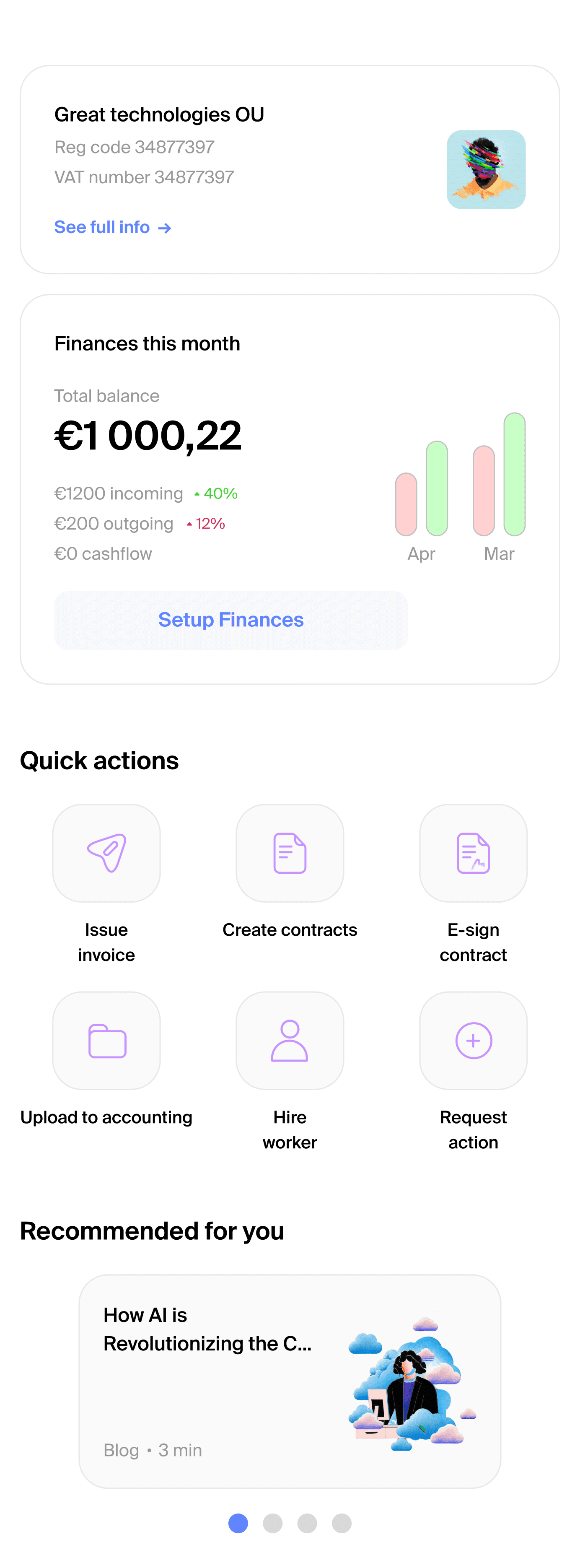

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

Fully transparent process

Always stay in the loop with precise terms, clear guidance, and firm deadlines

An accountant who knows your case

Get expert understanding of your business with a dedicated accountant and a personal manager

A single subscription you’d need

Strengthen Accounting with built-in Invoicing, Contracts, and Finances

What clients say about Enty

What clients say about Enty

What clients say about Enty

Enty is loved for cutting-edge products and exceptional support

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Paula

Founder of CamperDigital OÜ

I love ENTY service!

The people on the chat answer super quick any of my question and, in case they do not know the answer, they forward it to the right department, I don't have to do ANYTHING. The accountant super nice, writing everything clear, even when I have make a mistake or I have questions.

Elia Colombo

Graphic Designer and Brand Strategist

First experience was nothing short than great!

I had a little issue submitting my documents but Pablo was extremely helpful and quick in replying. He updated me on the manual verification process step by step. This first experience was nothing short than great and the fact I could interact with a real, caring human being is priceless nowadays!

Gi Hyun Nam

Founder of Parttiez OÜ

Enty stands out among other service providers

I chose Enty to open my company because the process was smooth and fast. I continue to stay with Enty because of their top-notch client support—they always listen and provide the perfect solutions. I was happy to start my journey with Enty, and I’m just as happy to continue it.

Lourdes Tandayag

Founder & CEO at Creciente

I LOVE Enty so much!

I wish there was one for EVERY country in this world! Honestly, the entire UI/UX has been excellent! From my initial calls with Arina (and the ongoing support!), to the daily interactions with the team via live chat and my client manager, Pablo - all have been very prompt and informative.

Nikita Soshnikov

CEO at Sheepy

These guys rock! Solid expertise and proactive approach

The platform’s user-friendly interface made it a breeze to navigate the services and engage with the team. This level of customer focus added to the overall positive experience, makes Enty a service provider I can recommend for consulting needs!

Andreas Reuter

Founder at NO DANCE MONKEY

I’m super happy with Enty!

We started our startup a year ago. But months before we have been already in touch with our future Enty account manager. Support is super nice and responsive. We are founders who came together to register our company in a digital friendly country. Keep up the good work Enty!

Vadim Movsesyan

Founder at Precise Communications OÜ

Fantastic customer service and user-friendly interface

Starting a business is easy. Running a business is hard. I appreciated the time that the customer service reps took to walk me through the process to hire my first employees. From start to finish, everything is automated, easy to understand, and easy to use.

Samantha Asensi

iGaming Consultant

I liked the idea of cooperating with friends

I checked the website and saw a super easy and straightforward service. I liked the idea of cooperating with friends, young company and I decided to move forward with you. I’m totally satisfied, honestly. You were doing follow-ups and helping me with everything all the time!

Have your reports done now!

Have your reports done now!

Have your reports done now!

Have a question on reporting?

Have a question on reporting?

Have a question on reporting?

Is it mandatory to file an annual report in Estonia?

Yes. All companies registered in the Estonian Business Register, including OÜs, must file an annual report every year.

Is it mandatory to file an annual report in Estonia?

Yes. All companies registered in the Estonian Business Register, including OÜs, must file an annual report every year.

Is it mandatory to file an annual report in Estonia?

Yes. All companies registered in the Estonian Business Register, including OÜs, must file an annual report every year.

My company had no activity last year. Do I still need to file an annual report?

Yes. Even if your company had zero activity, an annual report is still required.

My company had no activity last year. Do I still need to file an annual report?

Yes. Even if your company had zero activity, an annual report is still required.

My company had no activity last year. Do I still need to file an annual report?

Yes. Even if your company had zero activity, an annual report is still required.

What is the deadline for submitting an annual report in Estonia?

The annual report must be submitted within six months after the end of the financial year. For most companies, the deadline is 30 June.

What is the deadline for submitting an annual report in Estonia?

The annual report must be submitted within six months after the end of the financial year. For most companies, the deadline is 30 June.

What is the deadline for submitting an annual report in Estonia?

The annual report must be submitted within six months after the end of the financial year. For most companies, the deadline is 30 June.

What happens if I submit the report late?

Late submission may lead to fines or, in serious cases, removal of the company from the Business Register.

What happens if I submit the report late?

Late submission may lead to fines or, in serious cases, removal of the company from the Business Register.

What happens if I submit the report late?

Late submission may lead to fines or, in serious cases, removal of the company from the Business Register.

Can I file an Estonian annual report without an accountant?

Yes, it is legally possible. However, working with professional accountants helps avoid mistakes and saves time.

Can I file an Estonian annual report without an accountant?

Yes, it is legally possible. However, working with professional accountants helps avoid mistakes and saves time.

Can I file an Estonian annual report without an accountant?

Yes, it is legally possible. However, working with professional accountants helps avoid mistakes and saves time.

What documents do you need?

Usually bank statements and supporting documents such as invoices, contracts, or agreements that explain money movements. We’ll notify you about all the types of documents needed for your case.

What documents do you need?

Usually bank statements and supporting documents such as invoices, contracts, or agreements that explain money movements. We’ll notify you about all the types of documents needed for your case.

What documents do you need?

Usually bank statements and supporting documents such as invoices, contracts, or agreements that explain money movements. We’ll notify you about all the types of documents needed for your case.

How long does the process take?

In most cases, a few business days after we receive all required documents. For companies with zero activity, we usually submit the report within 2 business days.

How long does the process take?

In most cases, a few business days after we receive all required documents. For companies with zero activity, we usually submit the report within 2 business days.

How long does the process take?

In most cases, a few business days after we receive all required documents. For companies with zero activity, we usually submit the report within 2 business days.

Can I review the annual report before submission?

Yes. You review and approve the report before we submit it to the Estonian Business Register.

Can I review the annual report before submission?

Yes. You review and approve the report before we submit it to the Estonian Business Register.

Can I review the annual report before submission?

Yes. You review and approve the report before we submit it to the Estonian Business Register.

I have overdue annual reports. Can you help?

Yes. We can prepare and submit overdue reports for previous years. Pricing depends on the number of years and the complexity of the case.

I have overdue annual reports. Can you help?

Yes. We can prepare and submit overdue reports for previous years. Pricing depends on the number of years and the complexity of the case.

I have overdue annual reports. Can you help?

Yes. We can prepare and submit overdue reports for previous years. Pricing depends on the number of years and the complexity of the case.

Why do you offer early bird pricing?

Starting early helps us plan the work properly and keep the process smooth. Closer to the deadline, workloads increase, and timelines get tighter. Early bird pricing rewards companies that submit their requests in advance.

Why do you offer early bird pricing?

Starting early helps us plan the work properly and keep the process smooth. Closer to the deadline, workloads increase, and timelines get tighter. Early bird pricing rewards companies that submit their requests in advance.

Why do you offer early bird pricing?

Starting early helps us plan the work properly and keep the process smooth. Closer to the deadline, workloads increase, and timelines get tighter. Early bird pricing rewards companies that submit their requests in advance.

Didn’t find an answer? Ask us directly

Frequently Asked Questions (FAQ) are designed to provide quick answers to common inquiries about our services and features.

Didn’t find an answer? Ask us directly

Frequently Asked Questions (FAQ) are designed to provide quick answers to common inquiries about our services and features.

Didn’t find an answer? Ask us directly

Frequently Asked Questions (FAQ) are designed to provide quick answers to common inquiries about our services and features.