Invoice VAT Checker for Estonian Company

Find out whether you need to include VAT in a certain invoice of your company in Estonia. Easy, free, fast.

What is Invoice VAT Checker?

Get Answer in 1-3 Minutes

Swift solution to check whether you need to apply VAT to a certain invoice

Always Correct Invoices

All requirements of the Estonian VAT regulation are taken into account. The tool is approved by Estonian accountants and lawyers. Enty always upgrades the tool simultaneously with the new regulation.

Who Can Benefit?

Entrepreneurs, accountants, or client managers can check whether they are required to add VAT to a certain invoice

How it works

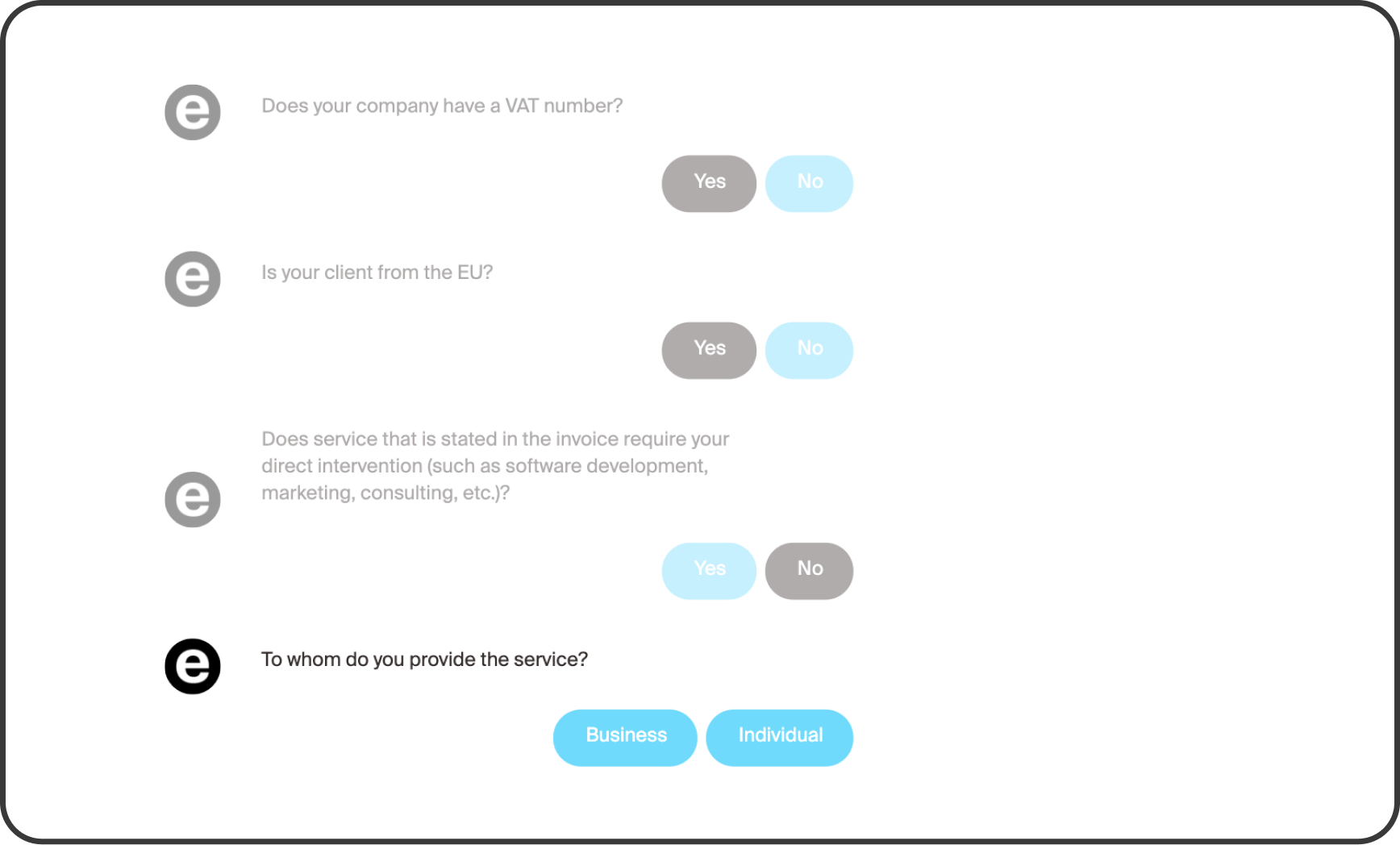

Answer a few questions regarding a certain invoice and clients/contractors in a small quiz.

Get an answer immediately. Together with the answer, VAT Checker provides an explanation of the decision and the basis for it in order to ensure correct operations.

1

2

Enty goes way beyond simple tools and offers a single subscription to manage a company

What’s included in subscription

Accounting

Choose the subscription, upload the needed documents, and we will create reports and file them to the authorities

Invoicing

Issue all outgoing invoices. Сreate accounting reports based on them

Open Banking

Integrate your bank account with Enty services. Reflect data in accounting reports

Virtual Office

A Contact Person. Required for each company in Estonia

VAT

All VAT needs of your company. Starting from application and filing VAT returns

HR

Manage HR-related data, calculate your payroll and social taxes

Corporate Secretary

Delegate tasks, apply for VAT, OSS, EORI, request assistance from authorities

Contract Management

Create and send contracts. Issue invoices based on your contracts

How our services benefit your company

Save up to 15 hours and €100 monthly with our subscriptions

Issue an invoice and send it to your client

Payment will be reflected in Open Banking

Paid invoice is automatically reflected in the accounting report

Enty will create and file accounting reports for you

Explore other free tools and useful materials for your company

Why choose Enty?

1500+

companies enjoy our services today

10K+

accounting reports prepared

e-Residency marketplace member

20

countries whose clients are already with us

Trusted e-Residency company

The service is provided under the FIU license № FIU000382

Listen what our clients speak

Look what people ask

The Value Added Tax, or VAT, in the European Union, is a general, a broadly based consumption tax that applies more or less to all goods and services that are bought and sold for use or consumption in the European Union.

No. In this case, you never need to add VAT to the invoice

VAT rate in Estonia is 22%, however, for specific goods and services (such as the production of books or workbooks used as learning material; production of particular medical goods; production of certain periodic publications or accommodation services or accommodation services with breakfast) it may be reduced to 9%

There are cases when the business is obliged to receive a VAT number, the main one being reaching a turnover of 40000 EUR. In addition, there are a number of reasons why getting a VAT number may benefit the business. For example, if you have an Estonian company and different expenses in Estonia, then you can get the VAT back for those expenses and use that money for your business. Complete our quiz to learn more about the requirements and benefits of getting a VAT number.