How to register as VAT payer in Estonia with e-residency

VAT always raises questions among those who have just started a company or found out that they must obtain a VAT number. Enty can easily take care of all your VAT problems, but in this case, we would like to tell you how you can register as a VAT payer yourself.

When VAT registration in obligatory

We have written separate articles about Estonia's general VAT rules, so we suggest you check them out if you’d like to learn more about regulation. But let’s repeat the main thing: the general rule in Estonia is that if your business makes more than €40,000 a year, you have to sign up for a VAT number. Also, the company becomes VAT-liable, if it participates in OSS or IOSS schemes.

There are also some cases when obtaining a VAT number might be beneficial for a company. In order to help you figure everything out, we’ve developed a free quiz-type tool that will tell you whether your company needs to obtain or might benefit from obtaining a VAT number.

Both the VAT checker and an overview of general VAT rules are available on the designated landing page, you can check them both out now.

Registration on the Estonian tax and customs board website

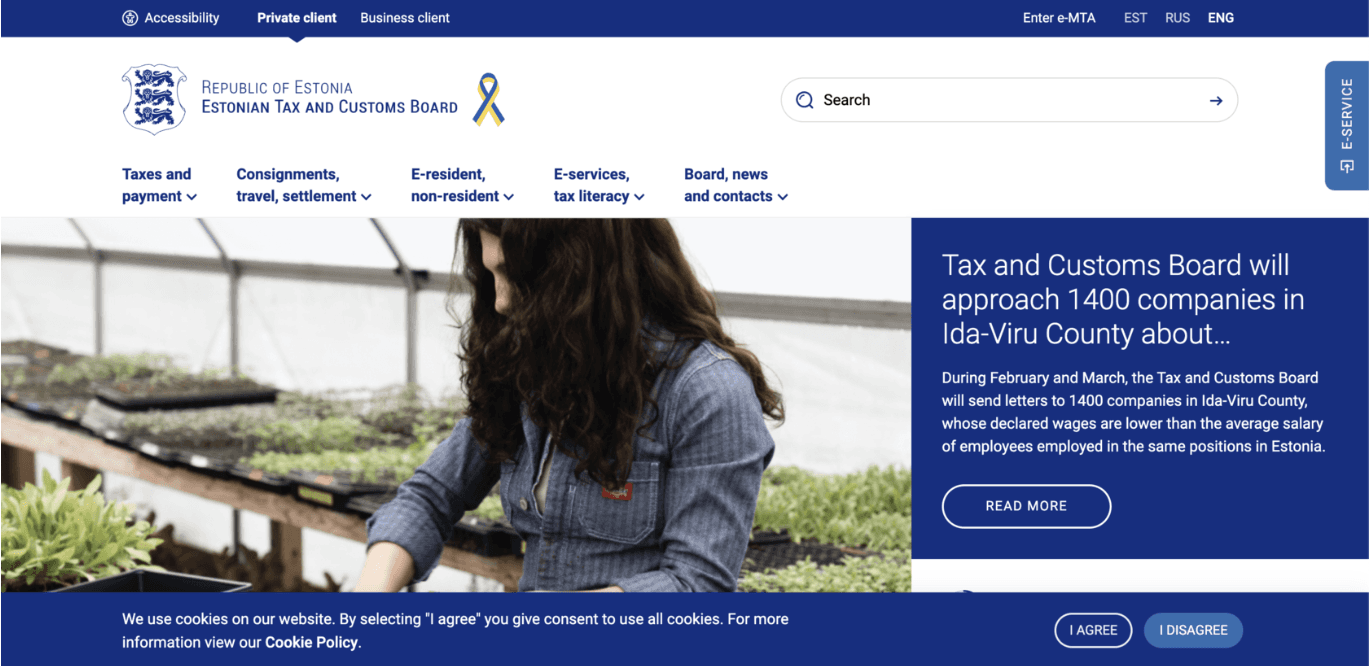

STEP 1: Go to the tax and customs board website

The company’s director must be the one to apply for the VAT registration.

The service is available in Estonian, English and Russian. You can switch the languages by clicking the one you prefer.

After that, press the “Enter e-MTA” button.

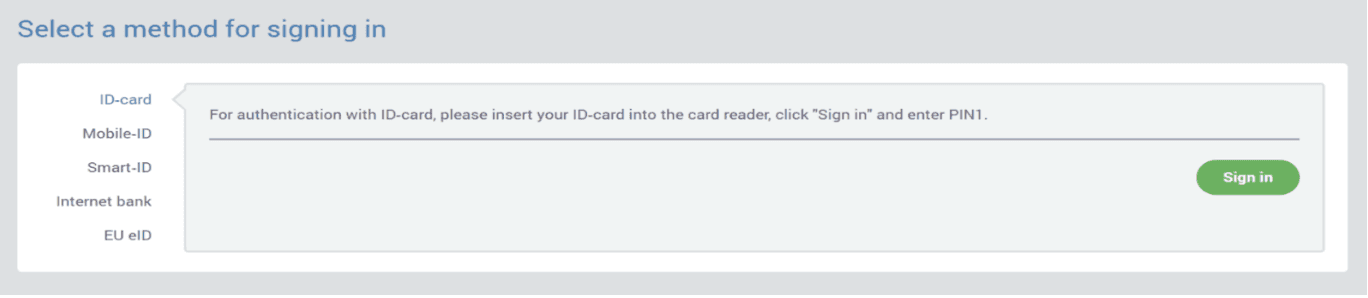

STEP 2: Log-in to the system

You can use your e-Residency card or SMART-ID to log-in. Select the preferred method of signing in and follow the instructions.

Please do not forget to insert your e-Residency card into the card reader anytime you want to use it

STEP 3: Registers and Inquiries (for VAT application)

Once you are logged in, press “Registers and inquiries” in the navigation bar on the left. After that, press “Registration of the VAT liable person”. Select the Represented person (i.e. your company).

STEP 4: Obtain the VAT number

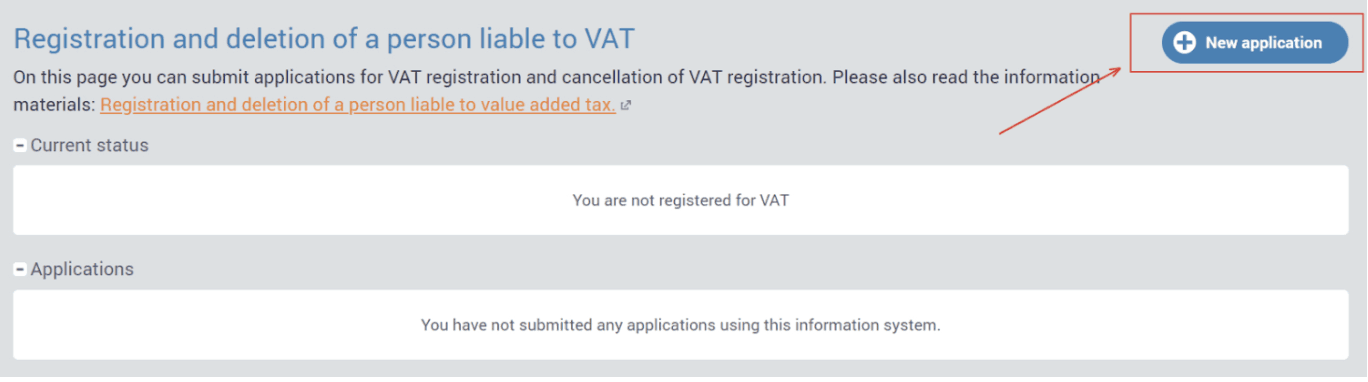

Start the VAT application by clicking on the blue button “New application” in the top right corner.

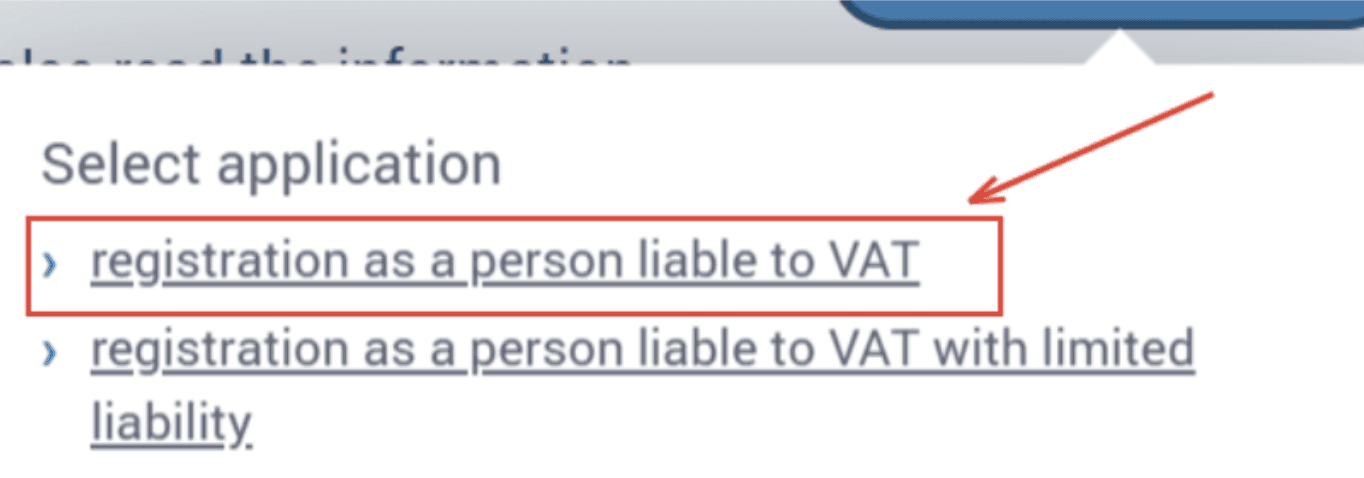

In the pop-up note, choose “Register as a person liable to VAT”.

The second option is for special cases, if your business requires a VAT number with limited liability, it is always the option advised by the Accountant.

STEP 5: Submit the VAT application

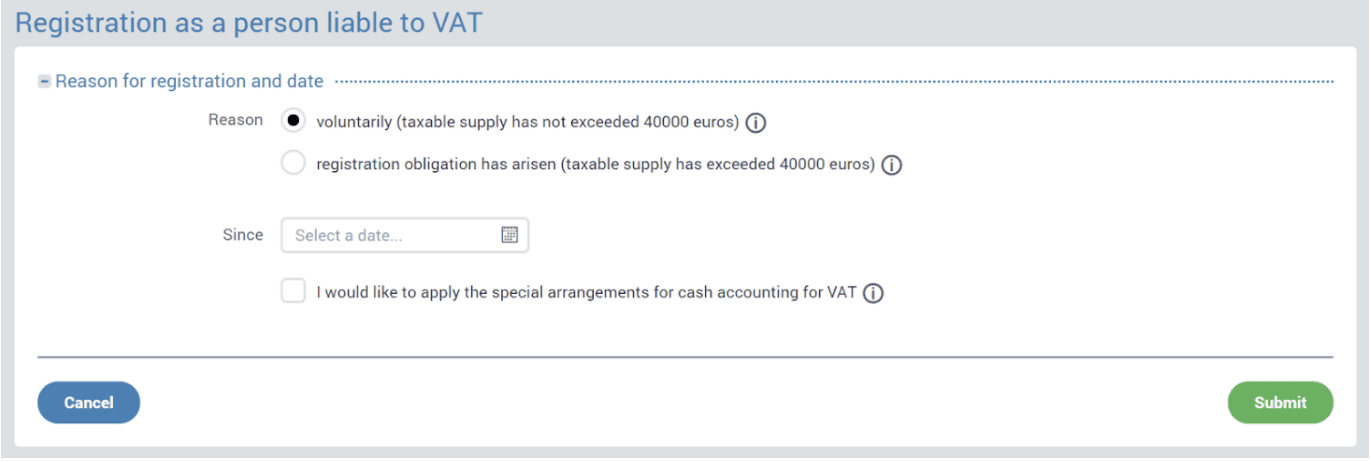

Here, you will need to choose the reason for registration and the date.

“Voluntarily” is chosen when your turnover has not exceeded 40000 EUR, and “Registration obligation has arisen” if it has.

Please note that in the later case, you have only 5 working days to submit your application.

Once you are ready, press submit.

And that’s it, you will receive the VAT number right after pressing the "Submit" button. Now you can register for VAT all by yourself, but Enty can do everything for you, explore our website to learn more.

But after receiving the VAT number, there will also be other issues that you will have to sort out and that’s where Enty can significantly simplify your workload.

VAT must be applied to invoices

A VAT liable company is required to apply a 22% VAT to invoices. However, there are cases when VAT is applied at a 0% rate. We won’t go over all cases now but we can tell you that if you issue invoices on Enty, the correct VAT rate will be applied automatically and you won’t need to think about that.

Monthly accounting reports are mandatory for companies with VAT number

Generally, Estonian companies are required to file accounting reports to regulators once a year. But companies with a VAT number are required to file VAT returns monthly. Failure or delay to submit VAT return might result in fines and deletion of a company from the register.

For someone unfamiliar with accounting or tax regulation, it might be quite challenging to file VAT returns correctly without mistakes that later might result in fines.

With Enty, you won't need to worry about it. All you need to do is upload all your invoices on a monthly basis in our system and our accountant will create and file a report to the authorities. Easy as that. All your actions are reduced to correct storage of invoices and uploading the files to our system in time. With our new Open Banking feature, you don't also need to care about your bank statement — it will be created automatically and processed by your accountant.

Outside of automating accounting and tax reporting for your company, we also include 1-hour consultation with an accountant per period in a package, so you will be able to make sure that everything is correct and address all questions to the professional.

That’s it! Apply for VAT using our guide and choose Enty to sort all other VAT-related and general paperwork issues.